United Spirits Ltd. vs. State of Madhya Pradesh 2025 INSC 833 - M.P. Entry Tax Act

You can read our notes if you are our subscriber. Click here to register @ citecase.in !

M.P. Entry Tax Act, 1976- Section 3B - Section 3B is only a machinery provision and in the teeth of Section 14 of the M.P. Entry Tax Act, it is not correct to say that there cannot be any assessment or collection of Entry Tax merely because there is no notification under Section 3B- Section 3B of the M.P. Entry Tax is an enabling provision. Further, the ‘non-obstante’ in Section 3B will not foreclose the operation of Section 14, since Section 3B will override only if there is a contrary provision. In the absence of any notification under Section 3B, there is nothing contrary in Section 14 for the non-obstante in Section 3B to be invoked to override Section 14. (Para 32-33)

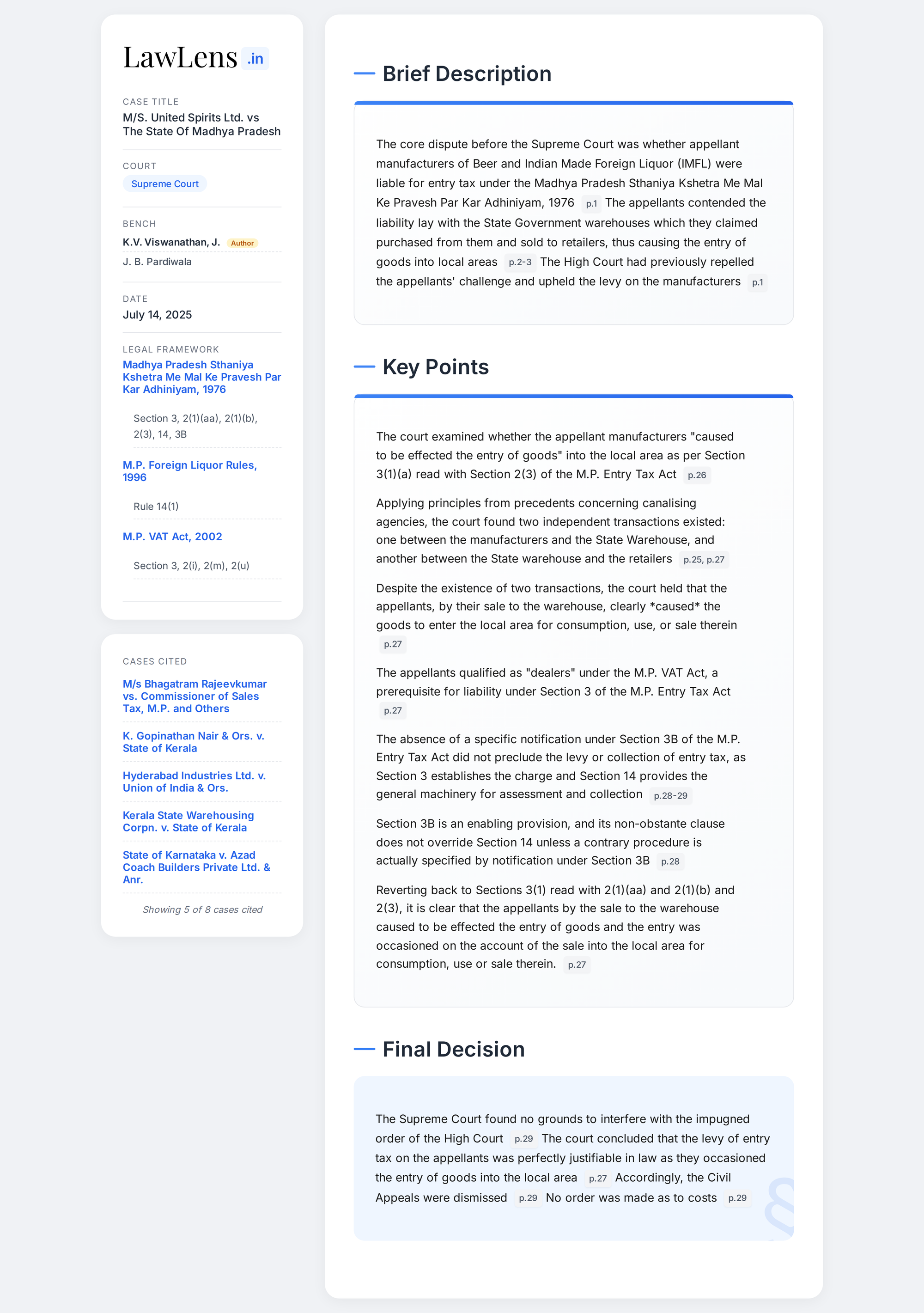

Case Info

Case Name and Neutral Citation

- Case Name: M/S United Spirits Ltd. v. The State of Madhya Pradesh & Ors.

- Neutral Citation: 2025 INSC 833

Coram (Judges)

- Justice J. B. Pardiwala

- Justice K. V. Viswanathan

Judgment Date

- Date of Judgment: July 14, 2025

Caselaws and Citations Referred

- K. Gopinathan Nair & Ors. v. State of Kerala, (1997) 10 SCC 1

- M/s Bhagatram Rajeevkumar v. Commissioner of Sales Tax, M.P. and Others, 1995 Supp. (1) SCC 673

- Hyderabad Industries Ltd. v. Union of India & Ors., (2000) 1 SCC 718

- Kerala State Warehousing Corpn. v. State of Kerala, (2005) 10 SCC 142

- State of Karnataka v. Azad Coach Builders Private Ltd. & Anr., (2010) 9 SCC 524

- Coffee Board, Bangalore v. Joint Commercial Tax Officer, Madras & Anr., (1969) 3 SCC 349

- A.G. Varadarajulu & Anr. v. State of T.N. & Ors., (1998) 4 SCC 231

- Union of India and Anr. v. G.M. Kokil & Ors., 1984 Supp SCC 196

Statutes/Laws Referred

- Madhya Pradesh Sthaniya Kshetra Me Mal Ke Pravesh Par Kar Adhiniyam, 1976 (M.P. Entry Tax Act, 1976)

- Madhya Pradesh VAT Act, 2002

- M.P. Excise Act, 1944

- Central Excise and Salt Act, 1944

- Additional Duties of Excise (Goods of Special Importance) Act, 1957

- Customs Act, 1962

- Sale of Goods Act, 1930

- Central Sales Tax Act, 1956