Tarachand Logistic Solutions Limited v. State of Andhra Pradesh 2025 INSC 1052 - Motor Vehicles Act - Tax

You can read our notes on this judgment in our Supreme Court Daily Digests. If you are our subscriber, you should get it in our Whatsapp CaseCiter Community at about 9pm on every working day. If you are not our subscriber yet, you can register by clicking here:

Andhra Pradesh Motor Vehicle Taxation Act, 1963 - Section 3 ; Andhra Pradesh Motor Vehicles Taxation Rules, 1963 - Rule 12A - If a motor vehicle is not used in a ‘public place’ or not kept for use in a ‘public place’ then the person concerned is not deriving benefit from the public infrastructure; therefore, he should not be burdened with the motor vehicle tax for such period - Motor vehicle tax is compensatory in nature. It has a direct nexus with the end use. The rationale for levy of motor vehicle tax is that a person who is using public infrastructure, such as, roads, highways etc. has to pay for such usage. (Para 46) , The words appearing in Rule 12A i.e. ‘a motor vehicle shall be deemed to be kept for use’ has to be read as ‘a motor vehicle deemed to be kept for use in a public place’. (Para 48)

Constitution of India - Article 265 - No tax shall be levied or collected except by authority of law. Thus, what Article 265 contemplates is that: (i) there must be a law; (ii) that law must authorize levy of tax; and (iii) the tax has to be levied or collected so authorized - Levy of tax has to be explicit. There cannot be exaction of tax by implication or by following an interpretative process. (Para 35-36)

Interpretation of Statutes - Tax Statutes - The charging section is the core of a taxing statute. Generally speaking, a taxing statute has to be construed literally; this is more so in the case of a charging section- In a taxing statute one has to look merely at what is clearly said. There is no room for any intendment. There is no equity about a tax. There is no presumption as to tax. Nothing is to be read in, nothing is to be implied- A subject is not to be taxed unless the words of the relevant taxing statute unambiguously imposes the tax on him. (Para 37) taxation statute has to be interpreted strictly because the State at its whims and fancies cannot burden the citizens without the authority of law -when the competent legislature mandates taxing certain persons/ certain objects in certain circumstances, it cannot be expanded/interpreted to include those, which were not intended by the legislature. (Para 38)

Interpretation of Statutes - A rule cannot traverse beyond the scope and ambit of the parent statute. (Para 47)

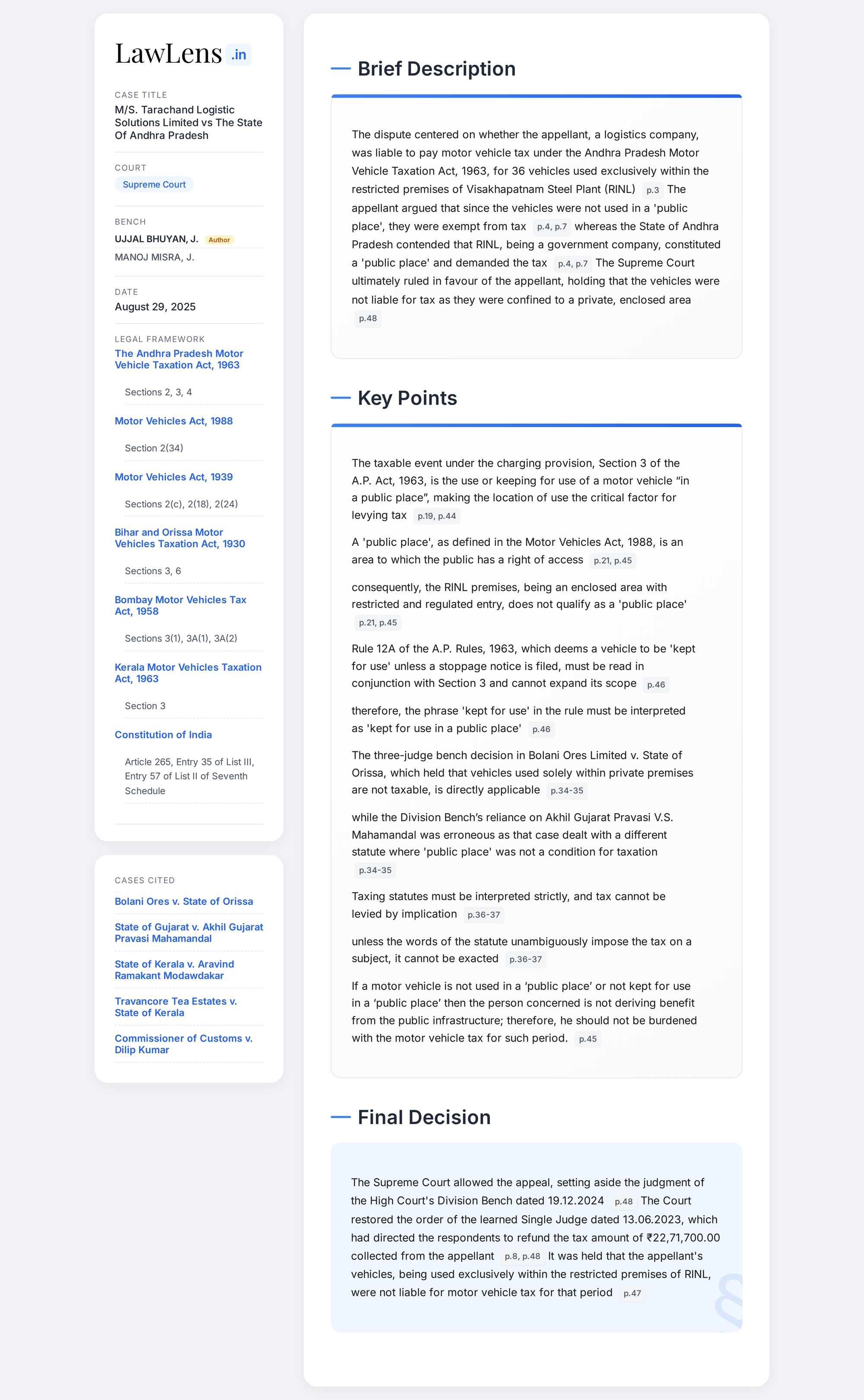

Case Info

Case Name and Neutral Citation

- Case Name: M/S. Tarachand Logistic Solutions Limited v. State of Andhra Pradesh & Ors.

- Neutral Citation: 2025 INSC 1052

Coram

- Coram: Hon’ble Mr. Justice Manoj Misra and Hon’ble Mr. Justice Ujjal Bhuyan

Judgment Date

- Date of Judgment: August 29, 2025

Caselaws and Citations Referred

- Bolani Ores Limited v. State of Orissa

- Citation: (1974) 2 SCC 777

- State of Gujarat v. Akhil Gujarat Pravasi V.S. Mahamandal

- Citation: (2004) 5 SCC 155

- State of Kerala v. Aravind Ramakant Modawdakar

- Citation: (1999) 7 SCC 400

- Travancore Tea Estates Co. Ltd. v. State of Kerala

- Citation: (1980) 3 SCC 619

- Commissioner of Customs v. Dilip Kumar

- Citation: (2018) 9 SCC 137

Statutes/Laws Referred

- The Andhra Pradesh Motor Vehicle Taxation Act, 1963

- Section 3 (Levy of tax on motor vehicles)

- Section 4 (Payment of tax and grant of licence)

- Section 2 (Definitions)

- The Andhra Pradesh Motor Vehicles Taxation Rules, 1963

- Rule 12A (Liability for payment of tax in respect of motor vehicles kept for use)

- Rule 12 (Payment of tax and penalty)

- Motor Vehicles Act, 1988

- Section 2(34) (Definition of ‘public place’)

- Constitution of India

- Article 265 (No tax shall be levied or collected except by authority of law)

- Entry 57 of List II (State List) of Seventh Schedule

- Entry 35 of List III (Concurrent List) of Seventh Schedule

- Bombay Motor Vehicles Tax Act, 1958

- Section 3A (Levy and collection of tax on omnibuses)

- Bombay Motor Vehicles Tax Rules, 1959

- Rule 5 (Declaration of non-use for refund of tax)

If a motor vehicle is not used in a ‘public place’ or not kept for use in a ‘public place’ then the person concerned is not deriving benefit from the public infrastructure; therefore, he should not be burdened with the motor vehicle tax for such period. https://t.co/RrwwsWfc7G pic.twitter.com/eIFsD9xPrM

— CiteCase 🇮🇳 (@CiteCase) August 29, 2025

#SupremeCourt explains why we should apply strict rule of interpretation for Taxing Statutes: https://t.co/RrwwsWfc7G pic.twitter.com/Nat1lFiLXX

— CiteCase 🇮🇳 (@CiteCase) August 29, 2025