Stemcyte India Therapeutics Pvt. Ltd. vs Commissioner Of Central Excise And Service Tax - Extension Of Limitation - Retrospective Operation Of Circular Or Notification

Finance Act, 1994 – Section 73 - In the absence of fraud, collusion, wilful misstatement, or suppression of facts with an intent to evade payment of service tax, the invocation of the extended period of limitation under is wholly unwarranted. Mere non-payment of service tax, by itself, does not justify the invocation of the extended limitation period. (Para 9.4)

Interpretation of Statute - Unless a notification or circular explicitly provides for retrospective operation, it must be construed as prospective. (Para 10.2)

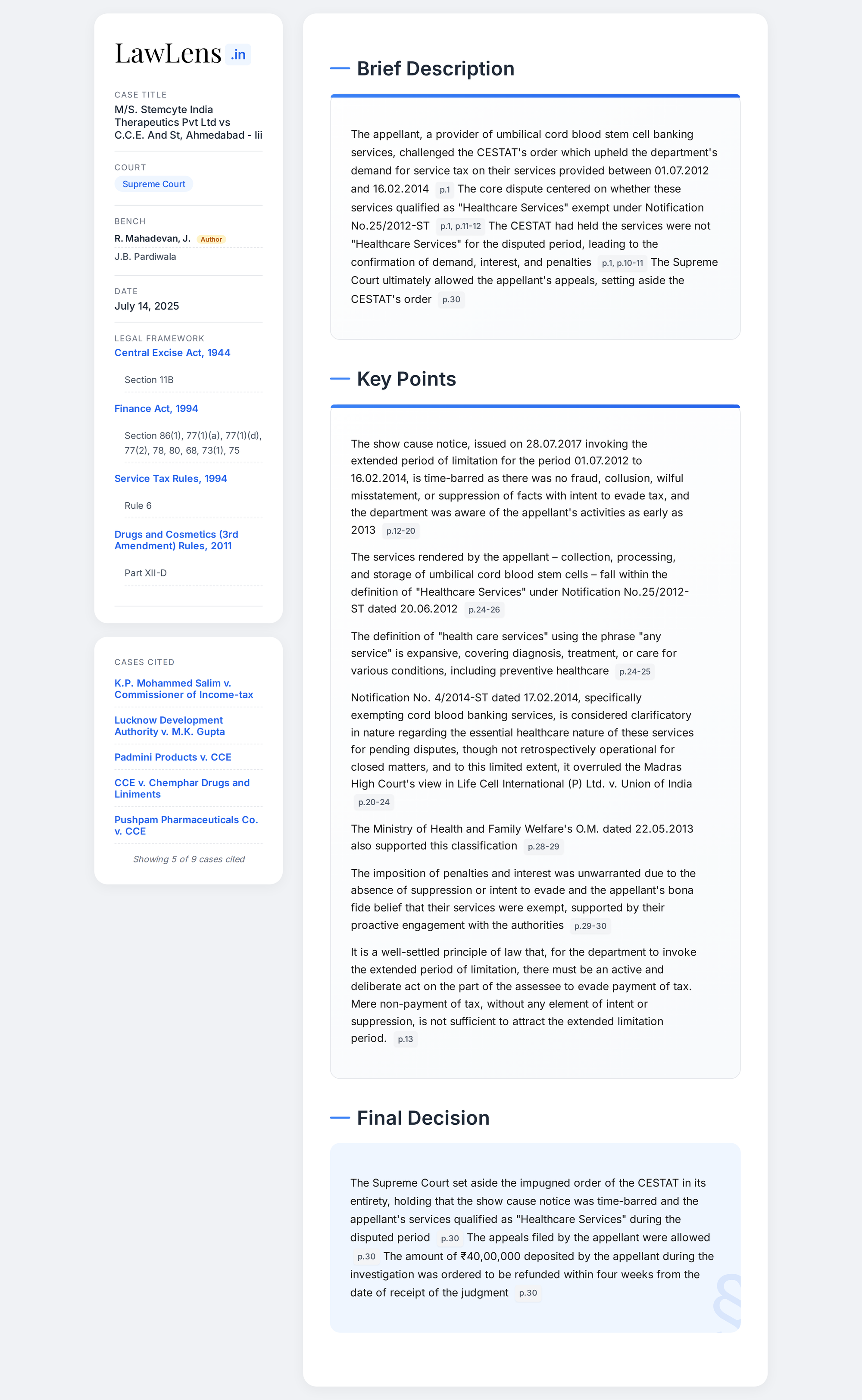

Case Info

Case Name and Neutral Citation

- Case Name: M/S. Stemcyte India Therapeutics Pvt. Ltd. v. Commissioner of Central Excise and Service Tax, Ahmedabad-III

- Neutral Citation: 2025 INSC 841

Coram

- Judges: J.B. Pardiwala and R. Mahadevan

Date of Judgment: July 14, 2025

Caselaws and Citations Referred

- K.P. Mohammed Salim v. Commissioner of Income-tax

- Citation: 2008 (11) SCC 573

- Lucknow Development Authority v. M.K. Gupta

- Citation: (1994) 1 SCC 243

- Padmini Products v. CCE

- Citation: (1989) 4 SCC 275

- CCE v. Chemphar Drugs and Liniments

- Citation: (1989) 2 SCC 127

- Pushpam Pharmaceuticals Co. v. CCE

- Citation: 1995 Supp (3) SCC 462

- CCE v. Punjab Laminates (P) Ltd.

- Citation: (2006) 7 SCC 431

- Life Cell International (P) Ltd. v. Union of India and others

- Citation: (2016) 6 VST-OL 50

- M. Satyanarayana Raju Charitable Trust v. UOI

- Citation: 2017 SCC OnLine Hyd 168

- CCE, Bombay-I & Anr. vs. Parle Exports Pvt. Ltd.

- Citation: (1989) 1 SCC 345

Statutes/Laws Referred

- Finance Act, 1994 (including Sections 68, 70, 73, 75, 77, 78, 80, and 86)

- Central Excise Act, 1944 (Section 11B)

- Service Tax Rules, 1994

- Drugs and Cosmetics Act, 1940 (and the Drugs and Cosmetics (3rd Amendment) Rules, 2011; Drugs and Cosmetics (Amendment) Rules, 2018)

- Notifications:

- Notification No. 25/2012–Service Tax dated 20.06.2012

- Notification No. 4/2014-ST dated 17.02.2014

- Notification No. GSR 899(E) dated 27.12.2011

- Notification No. GSR 334(E) (2018)

- Notification No. 213 dated 04.04.2018

Unless a notification or circular explicitly provides for retrospective operation, it must be construed as prospective.#SupremeCourt https://t.co/gwozIdnUPv pic.twitter.com/PYFDHv3itn

— CiteCase 🇮🇳 (@CiteCase) July 29, 2025

Suggested Readings:

Unless a notification or circular explicitly provides for retrospective operation, it must be construed as prospective.#SupremeCourt https://t.co/gwozIdnUPv pic.twitter.com/PYFDHv3itn

— CiteCase 🇮🇳 (@CiteCase) July 29, 2025