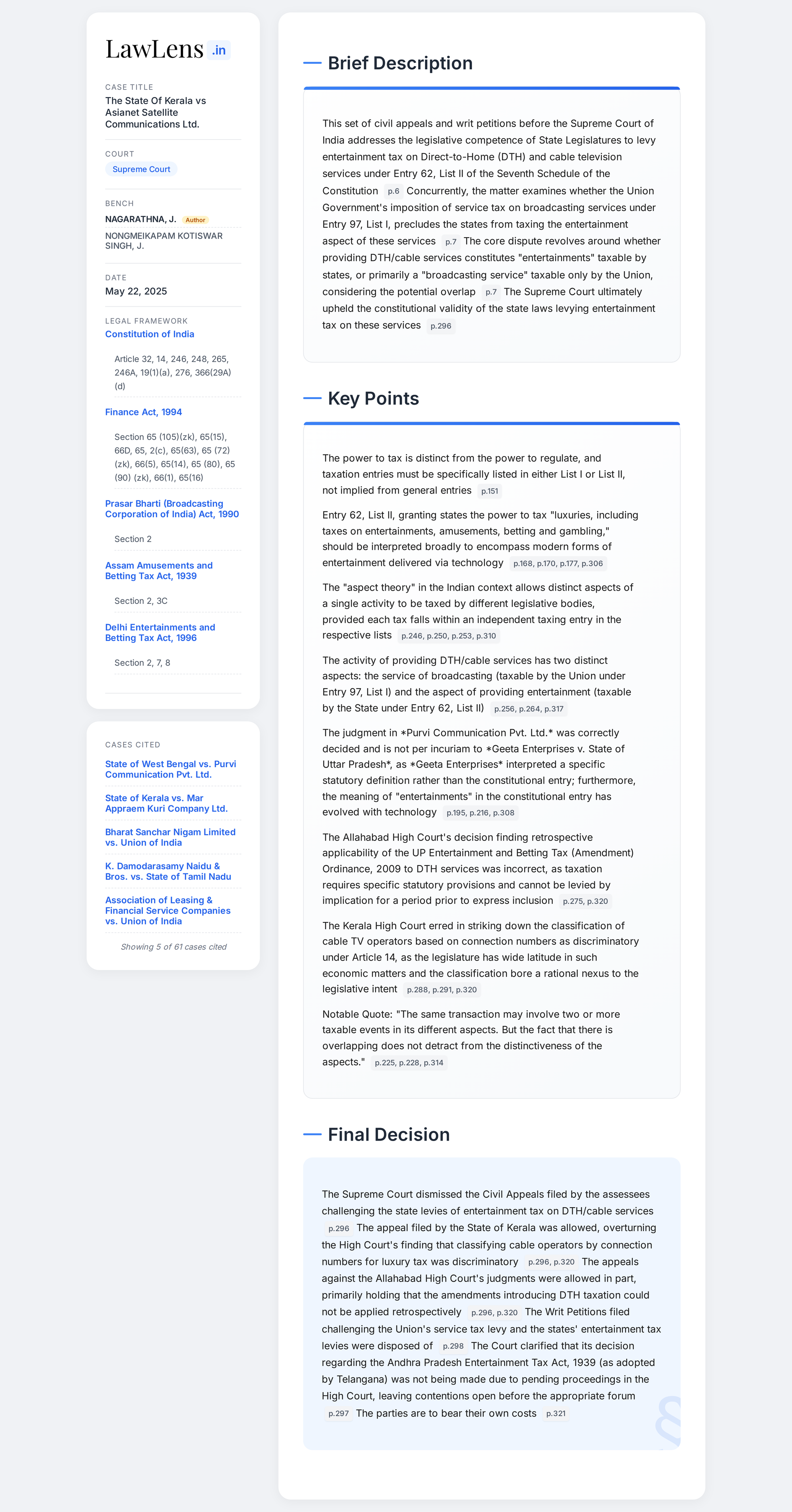

State Of Kerala vs Asianet Satellite Communications 2025 INSC 757 - Constitution - Taxation Powers - Entertainment Tax

Constitution of India - Seventh Schedule - Broadcasting is a form of communication and entertainment is a species of luxuries under Entry 62 – List II- State Legislature fully justified in imposing entertainment tax under Entry 62 – List II- The said entry contemplates imposition of taxes, inter alia, on the entire genus of “entertainments and amusements”- The pith and substance of the provisions of the State Act referred to above are in the realm of taxation of providers/receivers of entertainment/amusement as luxuries within the said Entry through the medium of television which involves broadcasting service which is regulated under Entry 31 – List I as a form of communication in accordance with Prasar Bharti Act, 1990. (Para 8)

Constitution of India - Seventh Schedule - Entry 31 – List I deals with various forms of communications including broadcasting. The said Entry does not deal with entertainments or amusements as luxuries. Entry 97 – List I deals with any other matter not enumerated in List II or List III including any tax not mentioned in either of those lists. Entry 31 - List I is a regulatory entry while Entry 97 - List I, inter alia, can be the basis for imposition of any tax such as service tax as per the provisions of the Finance Act, 1994 and its subsequent amendments. (Para 17.5)

Doctrine of pith and substance- If an enactment substantially falls within the powers expressly conferred by the Constitution upon the legislature which enacted it, the same cannot be held to be invalid merely because it incidentally encroaches on matters assigned to another legislature. Also, in a situation where there is overlapping, the said doctrine has to be applied to determine to which entry, a piece of legislation could be related to by examining the true character of the enactment or a provision thereof. Due regard must be had to the enactment as a whole and to its scope and objects. It is said that the question of invasion into another legislative territory has to be determined by substance and not by degree. According to the pith and substance doctrine, if a law is in its pith and substance within the competence of the Legislature which has made it, it will not be invalid because it incidentally touches upon the subject lying within the competence of another Legislature. (Para 8.22)

Constitution of India - Seventh Schedule - Taxation is considered to be a distinct matter for purposes of legislative competence and the power to tax cannot be deduced from the general legislative entry as an ancillary power. Also, a power to legislate as to the principal matter specifically mentioned in the entry shall also include within its expanse legislation touching only upon incidental and ancillary matters. But the power to levy tax cannot be considered to be an incidental and ancillary matter while interpreting an entry in the Lists concerning legislative competence of Parliament or legislature of any State to enact laws on the subjects mentioned in the entry. (8.2.17) while interpreting a taxation entry in List I or List II, all efforts must be made to interpret them in such a way as to give content and meaning to the same having regard to the constitutional scheme under which the distribution of legislative powers have been envisaged in the Seventh Schedule and bearing in mind and the object and intent behind them. (Para 17.12)

Taxation - A legislative enactment which provides for the imposition of a tax must specify the following parameters of taxation: (i) The taxable event which forms the basis of levy, also referred to as “subject” of a tax; (ii) The measure of the tax; (iii) The rate(s) of taxation; and (iv) The incidence of the tax. The said parameters are each distinct and must not be conflated with the others. (Para 8.26-27) Principles of interpretation of taxation entries- i. In interpreting expressions in the Legislative Lists of the Seventh Schedule of the Constitution, a wide meaning should be given to the entries. ii. In the scheme of the Lists in the Seventh Schedule, there exists a clear distinction between the general subjects of legislation and heads of taxation. They are separately enumerated. iii. As the fields of taxation are to be found clearly enumerated in Lists I and II, there can be no overlapping in law. There may be overlapping in fact, but there can be no overlapping in law. iv. In the first instance, the pith and substance or true nature and character of the legislation must be determined with reference to the legislative subject matter and the charging section; v. The measure of tax is not a true test of the nature of tax; vi. The same transaction may involve two or more taxable events in its different aspects. Merely because the aspects overlap, such overlapping does not detract from the distinctiveness of the aspects. (Para 11.18)

Aspect Theory - The ‘Aspect’ theory, also known as the ‘double aspect doctrine’- the aspect doctrine is applied to ascertain whether a legislature can tax on a particular aspect of a transaction/activity rather than on competence of a legislature vis-à-vis the scope of entries in List I or List II- The aspect theory, in the Indian context, comes into play at the level of determining the applicability of a taxing statute on the activity sought to be taxed. Invariably, an activity conducted by an assessee which is sought to be taxed by a legislation, may have different aspects. The aspect theory is used to determine if, in fact, there are different aspects within the activity sought to be taxed and whether, the taxable event which forms the basis of the levy in a legislative enactment corresponds to any aspect in the activity sought to be taxed. (Para 11.24)