State of Karnataka & Anr. v. Taghar Vasudeva Ambrish 2025 INSC 1381- IGST - Exemption - Purposive Interpretation

You can read our notes on this judgment in our Supreme Court Daily Digests. If you are our subscriber, you should get it in our Whatsapp CaseCiter Community at about 9pm on every working day. If you are not our subscriber yet, you can register by clicking here:

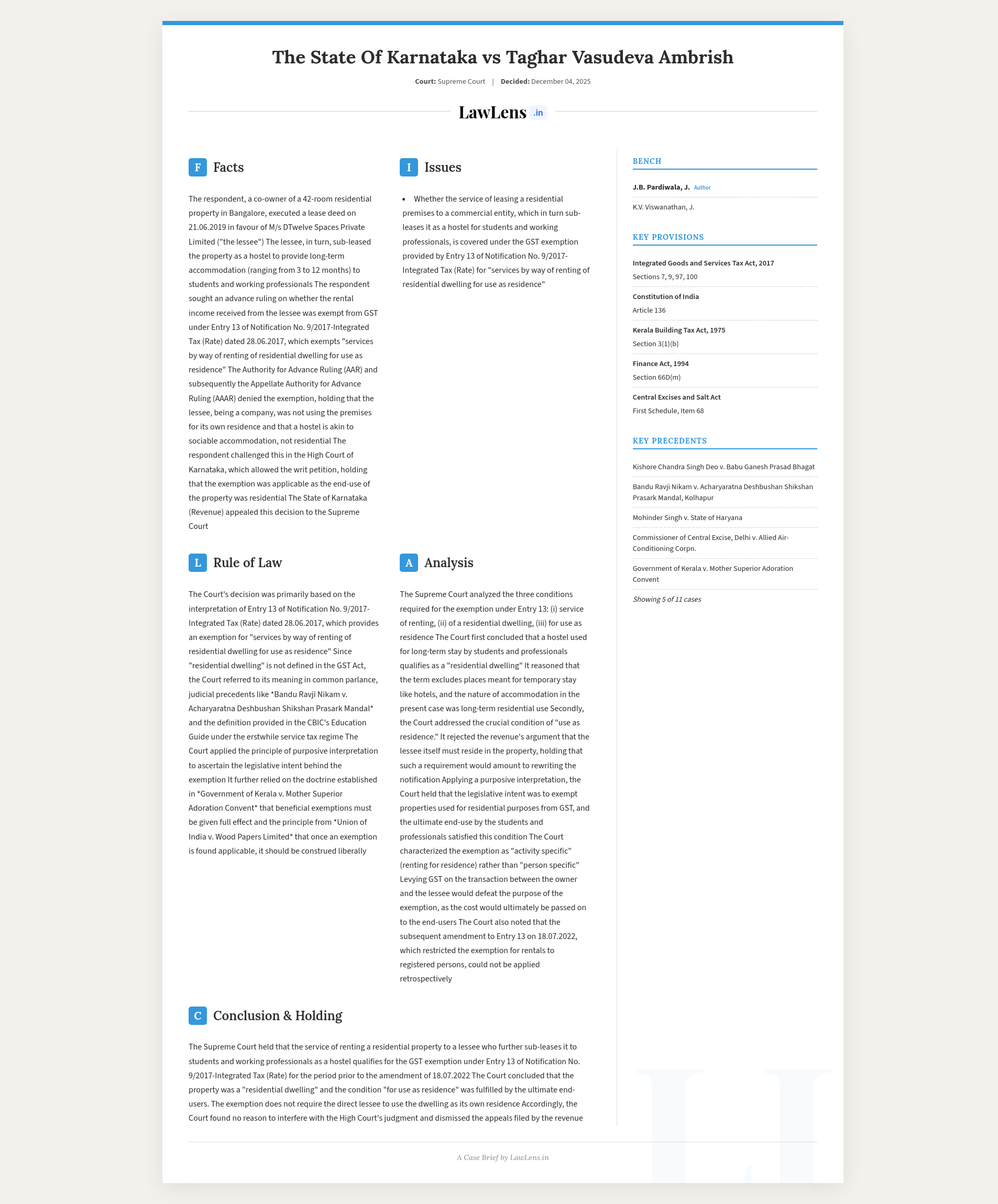

Integrated Goods and Services Tax Act, 2017 -Notification No. 9/2017- Integrated Tax (Rate) dated 28.06.2017 -Entry No. 13 - Authority for Advance Ruling, Karnataka held that the services provided in the form of leasing of residential premises as hostel to students and working professionals does not fall within the ambit of Entry 13 - High Court set aside AAAR order- Dismissing appeal, Supreme Court observed: Unconditional exemption was provided to renting of a residential dwelling to any person when the same is used for residence- GST is payable in the case of renting of a residential dwelling to any person when the same is used for the commercial purpose - Any residential accommodation meant for long term stay can be referred to as “residential dwelling”- Entry 13 of the Exemption Notification does not mandate that the lessee must use the residential dwelling as its own residence -Exemption is extended to cases wherein residential dwelling is rented out and ultimately used as residence, irrespective of the person using it (Para 61). Even if the rent is paid by a registered person, the exemption will be available if it is used for the purpose of own residence and is rented in the personal capacity. Therefore, the intention from the beginning was to ensure that rental agreements for use of the property for residential purposes are granted exemption from GST. (Para 68)

Interpretation of Statutes -The principle of ‘purposive interpretation’ or ‘purposive construction’ is based on the understanding that the Court is supposed to attach that meaning to the provisions which serve the ‘purpose’ behind such a provision. The basic approach is to ascertain what is it designed to accomplish? To put it otherwise, by interpretative process the Court is supposed to realise the goal that the legal text is designed to realise- Of the aforesaid three components, namely, language, purpose and discretion ‘of the Court’, insofar as purposive component is concerned, this is the ratio juris, the purpose at the core of the text. This purpose is the values, goals, interests, policies and aims that the text is designed to actualize. It is the function that the text is designed to fulfil -The statutory interpretation of a provision is never static but is always dynamic. Though literal rule of interpretation, till some time ago, was treated as the ‘golden rule’, it is now the doctrine of ‘purposive interpretation’ which is predominant, particularly in those cases where literal interpretation may not serve the purpose or may lead to absurdity. If it brings about an end which is at variance with the purpose of statute, that cannot be countenanced. Not only legal process thinkers such as Hart and Sacks rejected intentionalism as a grand strategy for statutory interpretation, and in its place they offered purposivism, this principle is now widely applied by the Courts not only in this country but in many other legal systems as well. (Para 59-60)

Case Info

- Case name: State of Karnataka & Anr. v. Taghar Vasudeva Ambrish & Anr.

- Neutral citation: 2025 INSC 1380

- Coram: J.B. Pardiwala, J.; K.V. Viswanathan, J.

- Judgment date: December 4, 2025

Caselaws and citations

- Kishore Chandra Singh Deo v. Babu Ganesh Prasad Bhagat, AIR 1954 SC 316

- Bandu Ravji Nikam v. Acharyaratna Deshbushan Shikshan Prasark Mandal, Kolhapur, 2003 (3) Mah L.J. 472

- Mohinder Singh v. State of Haryana, AIR 1989 SC 1367

- Commissioner of Central Excise, Delhi v. Allied Air-Conditioning Corpn., 2006 (7) SCC 735

- Government of Kerala v. Mother Superior Adoration Convent, (2021) 5 SCC 602

- Commr. of Customs v. Dilip Kumar & Co., (2018) 9 SCC 1

- Union of India v. Wood Papers Ltd., (1990) 4 SCC 256

- Collector of Central Excise v. Parle Exports (P) Ltd., (1989) 1 SCC 345

- V.L. Kashyap v. R.P. Puri, 12 (1976) DLT 369

- Uratemp Ventures Ltd. v. Collins, (2001) 3 WLR 806

- Privy Council decision referenced: AIR 1937 PC 46

Statutes/laws referred

- Integrated Goods and Services Tax Act, 2017 (Sections 97, 100)

- Notification No. 9/2017 – Integrated Tax (Rate) dated 28.06.2017, Entry 13; amendments effective 18.07.2022 and Explanation from 01.01.2023

- Finance Act, 1994 (Service Tax regime; CBIC Education Guide dated 20.06.2012, paras 4.13 and 4.13.1 defining “residential dwelling” in trade parlance)

- Karnataka Shops and Commercial Establishments Act, 1961 (mentioned as context)

- Bombay Rent Control Act (Section 25) in context of Bandu Ravji Nikam

- Income-tax Act, 1961 (Section 12AA) referenced for analogy to person-specific exemptions within GST notifications

#SupremeCourt clarifies on Literal Rule vs Purposive Interpretation; says latter is predominant now. https://t.co/5wTqhj7Jk7 pic.twitter.com/sey9hx1amL

— CiteCase 🇮🇳 (@CiteCase) December 4, 2025