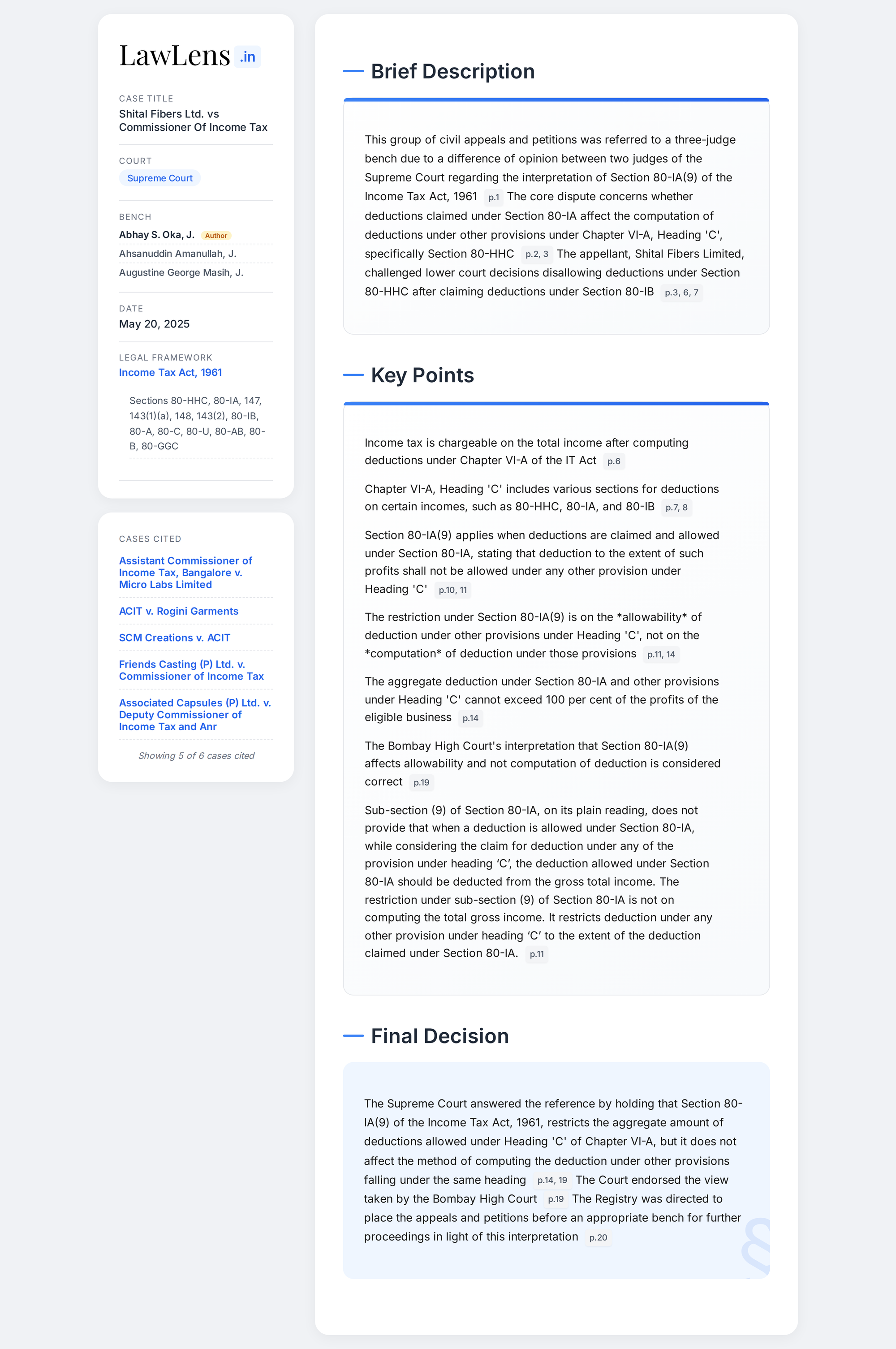

Shital Fibers Limited vs Commissioner of Income Tax 2025 INSC 743 - S. 80IA Income Tax Act

Income Tax Act 1961 - Section 80-IA - If a deduction of profits and gains under Section 80-IA is claimed and allowed, the deduction to the extent of such profits and gains in any other provision under the heading ‘C’ is not allowed. The deduction to the extent allowed under Section 80-IA cannot be allowed under any other provision under heading ‘C’. Therefore, if deduction to the extent of ‘X’ is claimed and allowed out of gross total income of ‘Y’ under Section 80-IA and the assessee wants to claim deduction under any other provision under the heading ‘C’, though he may be entitled to deduction ‘Y’ under the said provision, he will get deduction under the other provisions to the extent of (Y-X) and in no case total deductions under heading ‘C’ can exceed the profits and gains of such eligible business of undertaking or enterprise- Sub-section (9) of Section 80-IA, on its plain reading, does not provide that when a deduction is allowed under Section 80-IA, while considering the claim for deduction under any of the provision under heading ‘C’, the deduction allowed under Section 80-IA should be deducted from the gross total income. The restriction under sub-section (9) of Section 80-IA is not on computing the total gross income. It restricts deduction under any other provision under heading ‘C’ to the extent of the deduction claimed under Section 80- IA. (Para 20-21)