Pride Foramer S.A. vs Commissioner of Income Tax, 2025 INSC 1247 - Non -Resident Person - Permanent Establishment

Income Tax Act 1961 - Section 4 and Section 5(2) of the Act read with Section 9(1)(i) - A non-resident person shall be liable to pay tax on income which is deemed to accrue or arise in India- None of these provisions make it mandatory for a non-resident assessee to have a permanent establishment in India to carry on business or have any business connection in India. The issue of ‘permanent establishment’ may be relevant for the purposes of availing the beneficial provisions of the Double Tax Avoidance Agreement (DTAA) between India and France which is not a relevant consideration for the purposes of this case. [Context: SC held that High Court’s restrictive interpretation that a non-resident company making business communications with an Indian entity from its foreign office cannot be construed to be carrying on business in India is wholly anachronistic with India’s commitment to Sustainable Development Goal relating to ‘ease of doing business’ across national borders] (Para 19-20)

Income Tax Act 1961- Section 37(1), 71- A business going through a lean period of transition which could be revived if proper circumstances arose, must be termed as lull in business and not a complete cessation of the business. (Para 14)

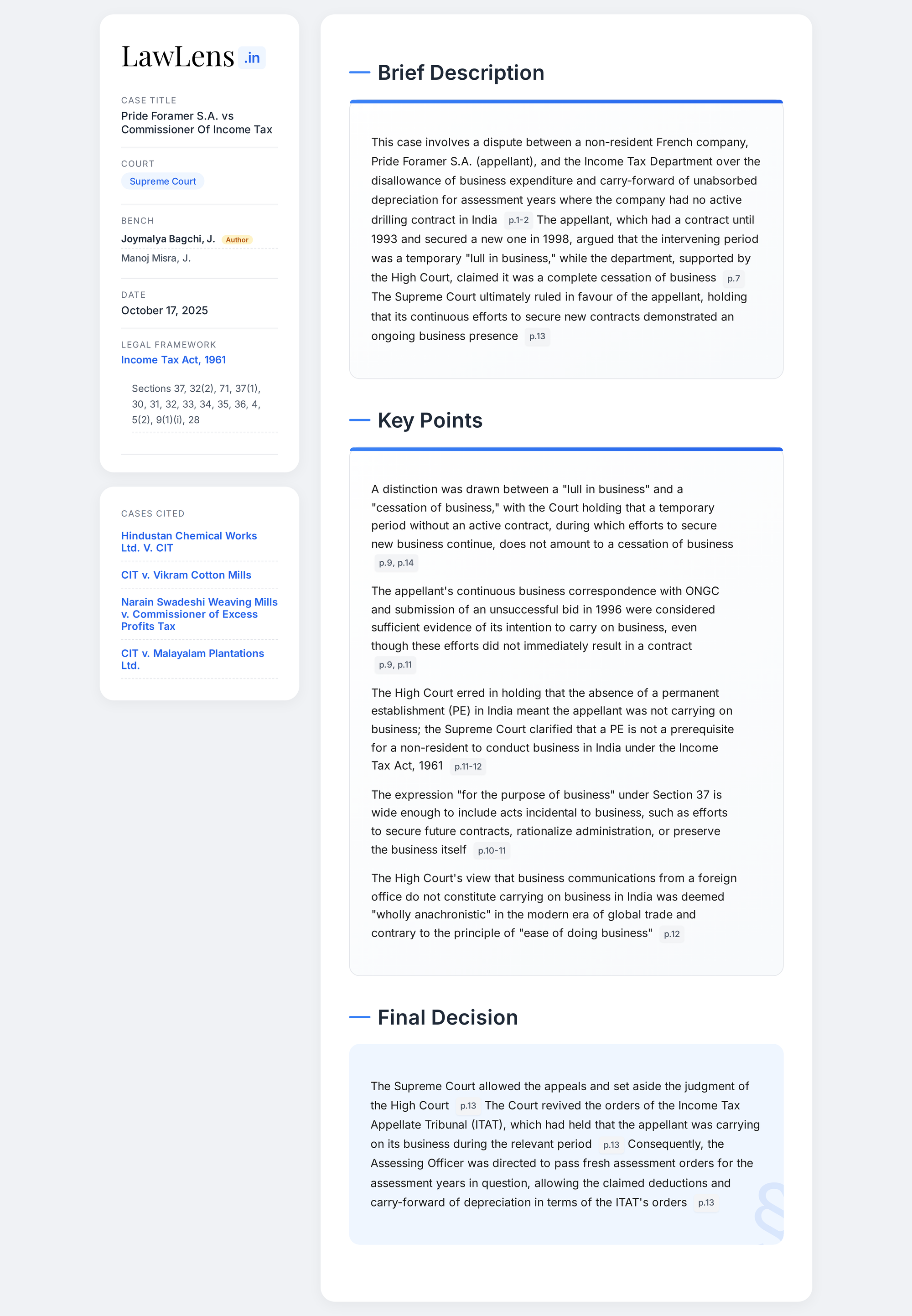

Case Info

Case Details

- Case name: Pride Foramer S.A. vs Commissioner of Income Tax & Anr.

- Neutral citation: 2025 INSC 1247.

- Coram: Justice Manoj Misra and Justice Joymalya Bagchi.

- Judgment date: October 17, 2025.

- Appeal nos.: Civil Appeal Nos. 4395-4397/2010.

- Court: Supreme Court of India, Civil Appellate Jurisdiction.

Statutes / Laws Referred

- Income Tax Act, 1961: Sections 37(1) (business expenditure), 71 (set-off of loss against other heads), 32(2) and its first proviso (unabsorbed depreciation; proviso omitted w.e.f. April 1, 2002), 4 (charging section), 5(2) (scope of total income for non-residents), 9(1)(i) (business connection; income deemed to accrue in India).

- DTAA (India–France): Referred contextually regarding “permanent establishment” (not determinative for this case’s issues).

Caselaws and Citations

- CIT v. Vikram Cotton Mills, (1988) 169 ITR 597 (SC) — on cessation vs temporary lull in business; intention inferred from conduct.

- Hindustan Chemical Works Ltd. v. CIT, 124 ITR 561 (Bom) — distinction between “lull in business” and “going out of business”.

- Narain Swadeshi Weaving Mills v. Commissioner of Excess Profits Tax, (1954) 2 SCC 546 — wide import of “business”.

- CIT v. Malayalam Plantations Ltd., (1964) 53 ITR 140 (SC) — “for the purpose of business” broader than “for the purpose of earning profits”; includes acts incidental to carrying on business.

#SupremeCourt holds that it is NOT mandatory for a non-resident assessee to have a permanent establishment in India to carry on business or have any business connection in India.

— CiteCase 🇮🇳 (@CiteCase) October 17, 2025

Such an interpretation is wholly anachronistic with India’s commitment to Sustainable Development… https://t.co/IZwaQSxgpu pic.twitter.com/CXyHZKPsyr

A business going through a lean period of transition which could be revived if proper circumstances arose, must be termed as lull in business and not a complete cessation of the business.#SupremeCourt https://t.co/IZwaQSxgpu pic.twitter.com/EpysZhKBMV

— CiteCase 🇮🇳 (@CiteCase) October 17, 2025