Patanjali Foods Limited vs Union Of India 2025 INSC 733- Section 27 Customs Act - Unjust Enrichment Doctrine - Bank Guarantee

Customs Act, 1962 - Section 27- The key word in Section 27 is ‘paid’. Refund thereunder is permissible only if any duty is ‘paid’ by the claimant which subsequently becomes refundable either fully or in part- The encashment of bank guarantees offered as security cannot be treated as payment of customs duty. Respondents could have either awaited the decision of this Court or could have directed Such encashment of bank guarantees cannot be treated as payment of duty or duty paid by a claimant. In such circumstances, the doctrine of unjust enrichment or Section 27 of the Customs Act would not be applicable. (Para 30)

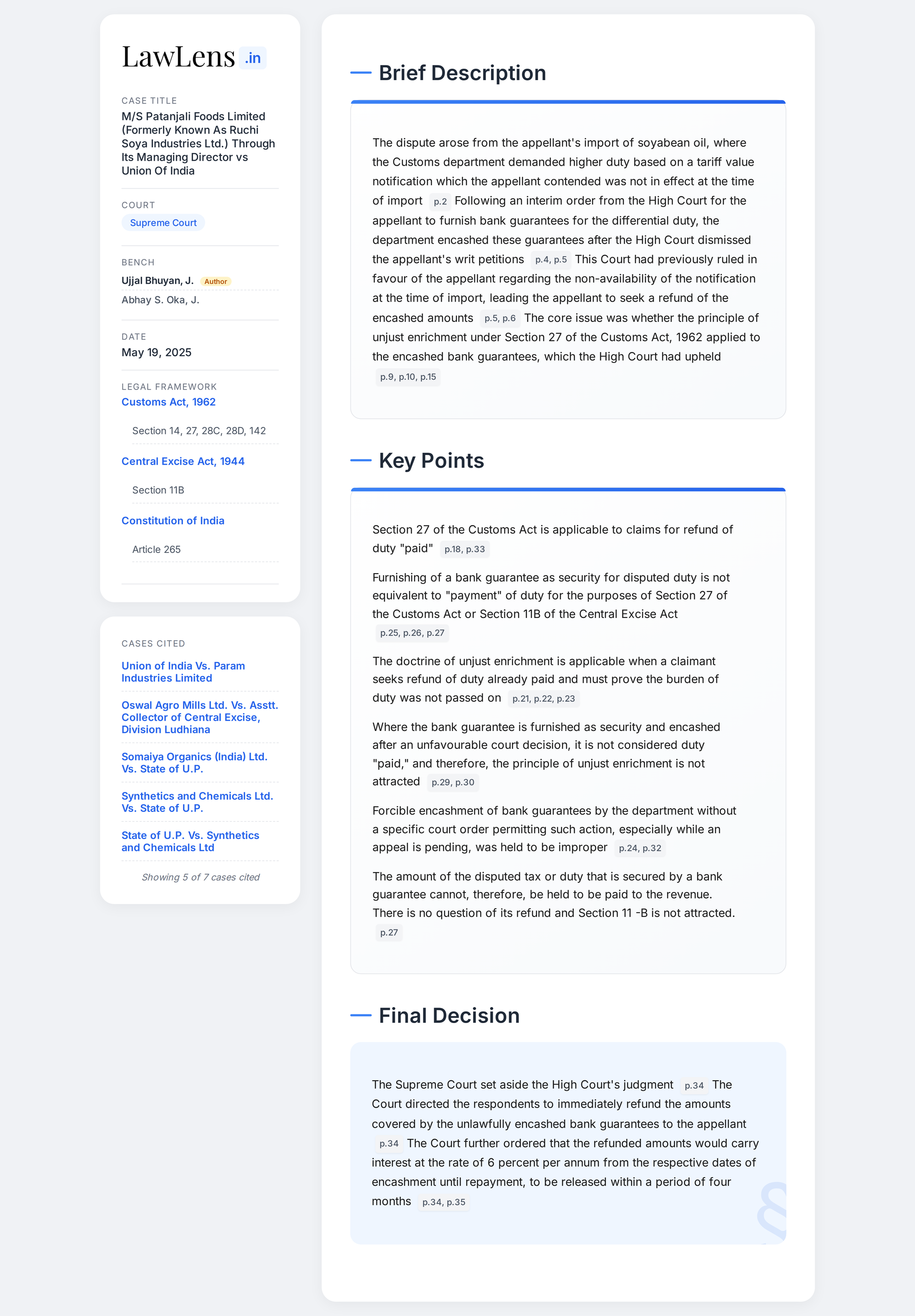

LawLens - AI-Driven Legal Research for Indian Laws

Discover AI-powered legal research tools for Indian law professionals