Orion Conmerx Pvt. Ltd. v. National Insurance Co. Ltd. 2025 INSC 1271 - Fire Insurance

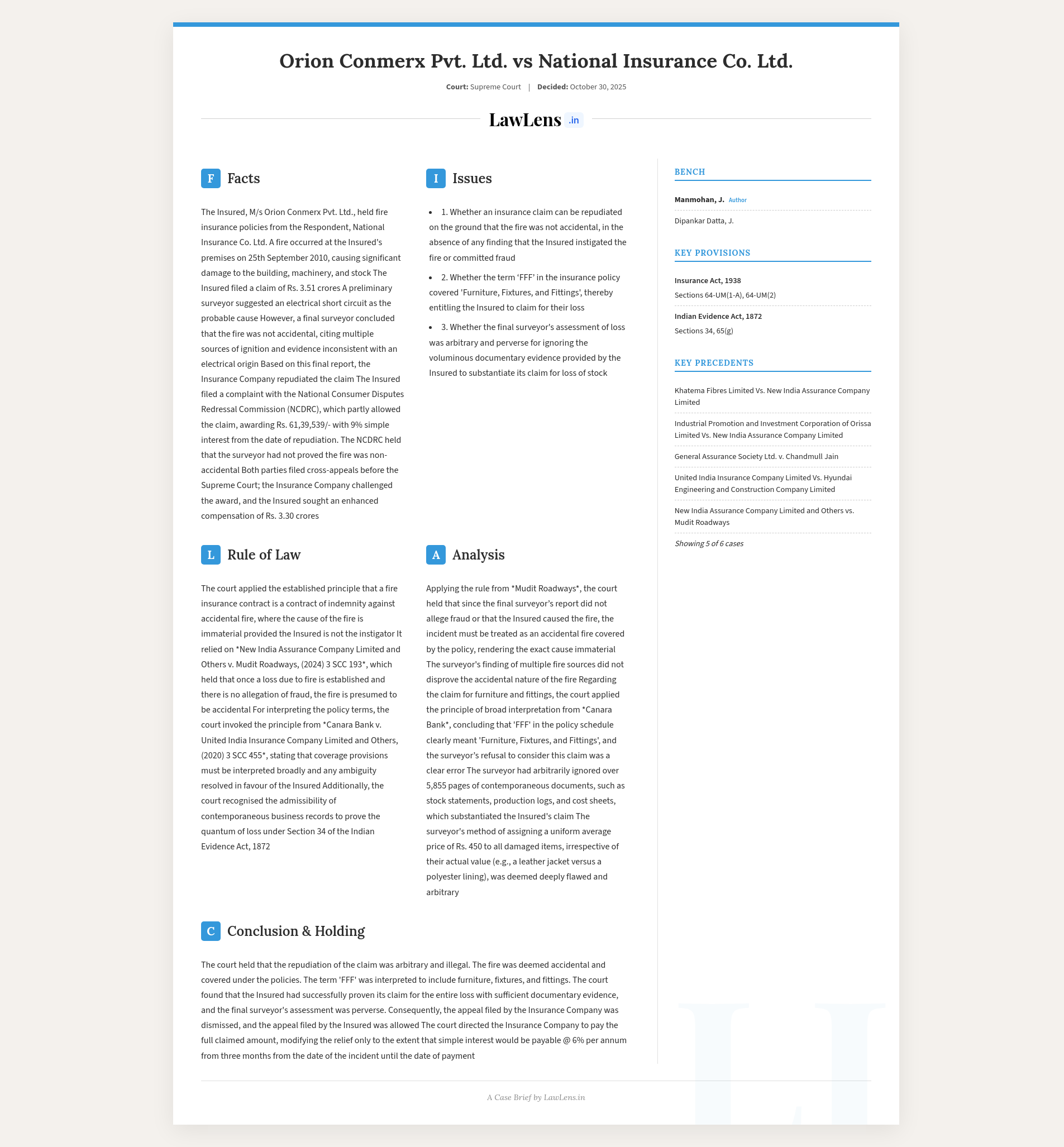

Fire Insurance - Once it is established that the loss is due to fire and there is no allegation/finding of fraud or that the Insured is the instigator of the fire, the cause of fire is immaterial and it will have to be assumed and presumed that the fire is accidental and falls within the ambit and scope of fire policy. (Para 37) the cause of fire becomes material in cases where the fire is occasioned not by negligence but by the wilful act of Insured himself or of someone acting with his privity or consent. In such a case, his conduct, coupled with the making of a claim, is a fraud upon the insurers and he cannot enforce his claim against them. (Para 35) [Context: In this case, the final Surveyor’s report only found that electric short circuit is not the sole source and that there were three independent sources/seats/pools of fire- SC held that the said finding cannot lead to the conclusion that the fire in question is not accidental.(Para 41)]

Fire Insurance - The contract of fire insurance is a contract to indemnify the Insured against loss by fire. The expression ‘fire’ signifies the cause of the loss and in order to determine whether in a particular case the loss is caused by fire, the following rules generally apply:- a) There must be an actual fire; hence mere heating or fermentation will not be sufficient to render the insurers liable for loss occasioned thereby. b) There must be something on fire which ought not to have been on fire. c) There must be something in the nature of an accident, but a fire occasioned by the wilful act of a third person without the consent of the Insured, is to be regarded as accidental for the purpose of this rule. If these requisites are satisfied, any loss attributable to the fire, whether by actual burning or otherwise, is within the contract. (Para 33)

Insurance - Coverage provisions should be interpreted broadly and in case of ambiguity, it is to be resolved in favour of the Insured. (Para 47) The policies provide for coverage of ‘FFF’ which can only mean furniture, fixtures and fittings and the Insured is entitled to the amounts claimed under the heads of Building, Plant and Machinery, Showroom, Electric fittings, furniture and fixtures. (Para 48)

Depreciation- The sine qua non for calculation of depreciation is the age of machinery and the accepted rate of depreciation for the products. (Para 61)

Case Info

Case Details

- Case name: Orion Conmerx Pvt. Ltd. v. National Insurance Co. Ltd.

- Neutral citation: 2025 INSC 1271

- Coram: Justice Dipankar Datta; Justice Manmohan.

- Judgment date: October 30, 2025.

Caselaws and Citations

- New India Assurance Co. Ltd. v. Mudit Roadways, (2024) 3 SCC 193.

- Khatema Fibres Ltd. v. New India Assurance Co. Ltd., (2023) 15 SCC 327.

- Industrial Promotion & Investment Corp. of Orissa Ltd. v. New India Assurance Co. Ltd., (2016) 15 SCC 315.

- United India Insurance Co. Ltd. v. Hyundai Engineering & Construction Co. Ltd., (2024) 6 SCC 310.

- Canara Bank v. United India Insurance Co. Ltd., (2020) 3 SCC 455.

Statutes / Laws Referred

- Insurance Act, 1938, Section 64-UM and Regulations on surveyor code of conduct.

- Indian Evidence Act, 1872, Sections 34 (entries in books of account) and 65(g) (secondary evidence).

- General principles of fire insurance (indemnity; doctrine of uberrima fides; accidental fire coverage and exclusions).

Once it is established that the loss is due to fire and there is no allegation/finding of fraud or that the Insured is the instigator of the fire, the cause of fire is immaterial and it will have to be assumed and presumed that the fire is accidental and falls within the ambit… https://t.co/JeJ7Gc9GoI pic.twitter.com/9erDmWjFuv

— CiteCase 🇮🇳 (@CiteCase) October 30, 2025