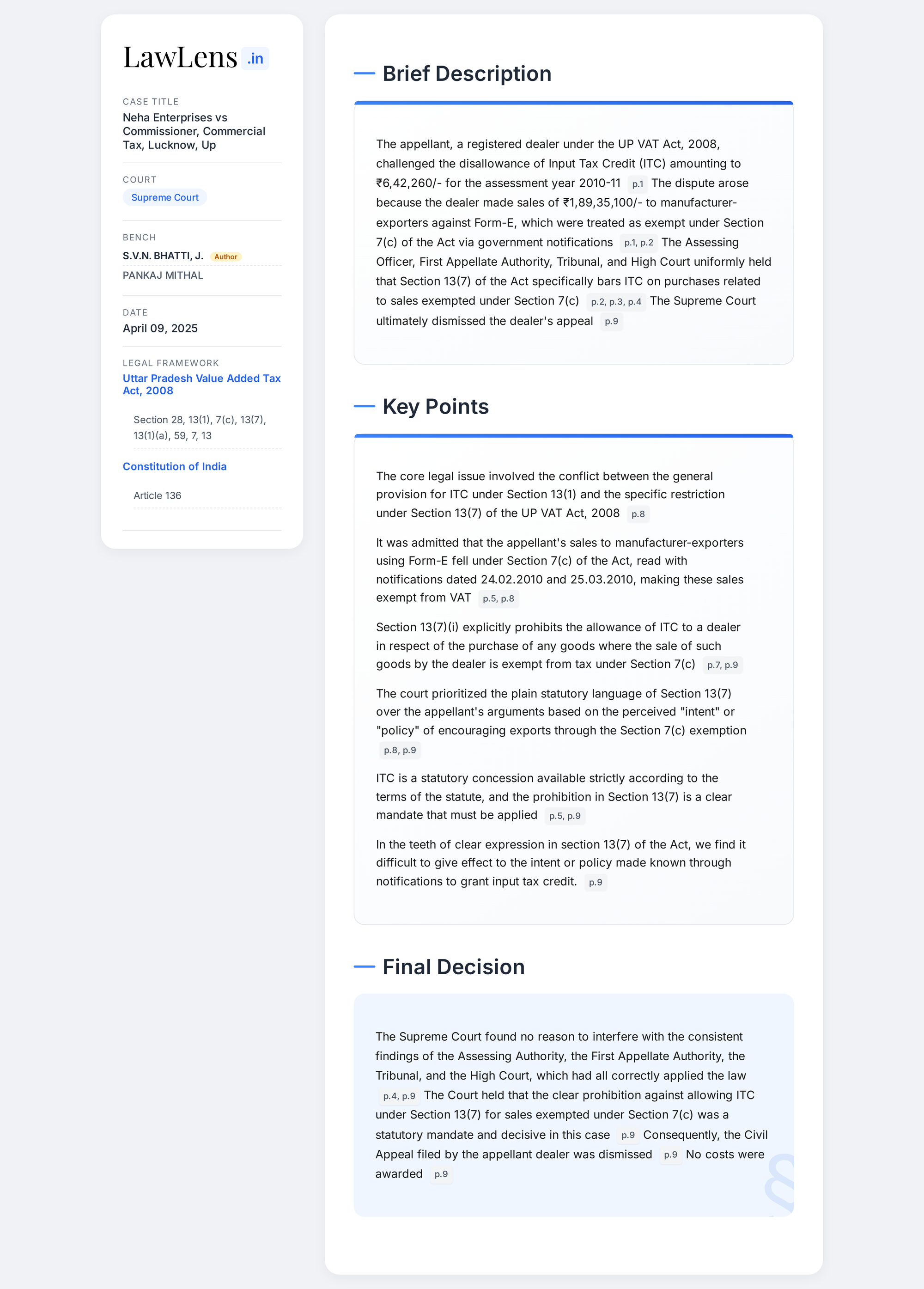

Neha Enterprises vs Commissioner, Commercial Tax 2025 INSC 476 - UP Vat - Taxation

Uttar Pradesh Value Added Tax Act, 2008 - Section 13 - Section 13(1) provides for allowing credit of an amount as input tax credit to the extent provided by or under the relevant clause to which the applicable condition is attracted. If the purchased goods are resold in the course of exporting the goods out of India, then the full amount of input tax credit can be claimed. Section 13(7) outlines the circumstances under which such a benefit cannot be allowed. Section 13(7) also sets out that no facility for input tax credit shall be allowed to a dealer with respect to the purchase of any goods where the sale of such goods by the dealer is exempt from tax under Section 7(c) of the Act. The prohibition from allowing input tax credit is a statutory mandate. (Para 10)