Hyatt International Southwest Asia Ltd. vs. Additional Director of Income Tax 2025 INSC 891 - DTAA -Permanent Establishment

Agreement between the Government of India and the UAE for the Avoidance of Double Taxation (DTAA) - What constitutes a “place of business” under Article 5(1) of the DTAA ? For a Permanent Establishment (PE) to exist, two essential conditions must be satisfied: (i)the place must be “at the disposal” of the enterprise, and (ii)the business of the enterprise must be carried on through that place - A PE must demonstrate the three core attributes of: stability, productivity, and a degree of independence. Among these, the “disposal test” is pivotal, meaning thereby the enterprise must have a right to use the premises in such a way that enables it to carry on its business activities. This test is to be applied contextually, taking into account the commercial and operational realities of the arrangement- Under DTAAs, the taxing rights of the source State over the business profits of a foreign enterprise are contingent upon the existence of a Permanent Establishment in the source country. One of the sine qua non for a fixed place PE is that the place through which the business is carried on must be ‘at the disposal’ of the enterprise – a principle commonly referred to as the “disposal test” - There is no strait-jacket formula applicable to all cases- Determining whether a Fixed place PE exists must involve a fact-specific inquiry, including: the enterprise’s right of disposal over the premises, the degree of control and supervision exercised, and the presence of ownership, management, or operational authority. (Para 13-15) [Context: SC held that Hyatt International Southwest Asia Ltd., a UAE-based company, has a “fixed place” Permanent Establishment (PE) in India under Article 5(1) of the India–UAE Double Taxation Avoidance Agreement (DTAA) due to its substantial and continuous operational control over hotel activities in India. As a result, the income received by Hyatt under its Strategic Oversight Services Agreement (SOSA) is taxable in India]

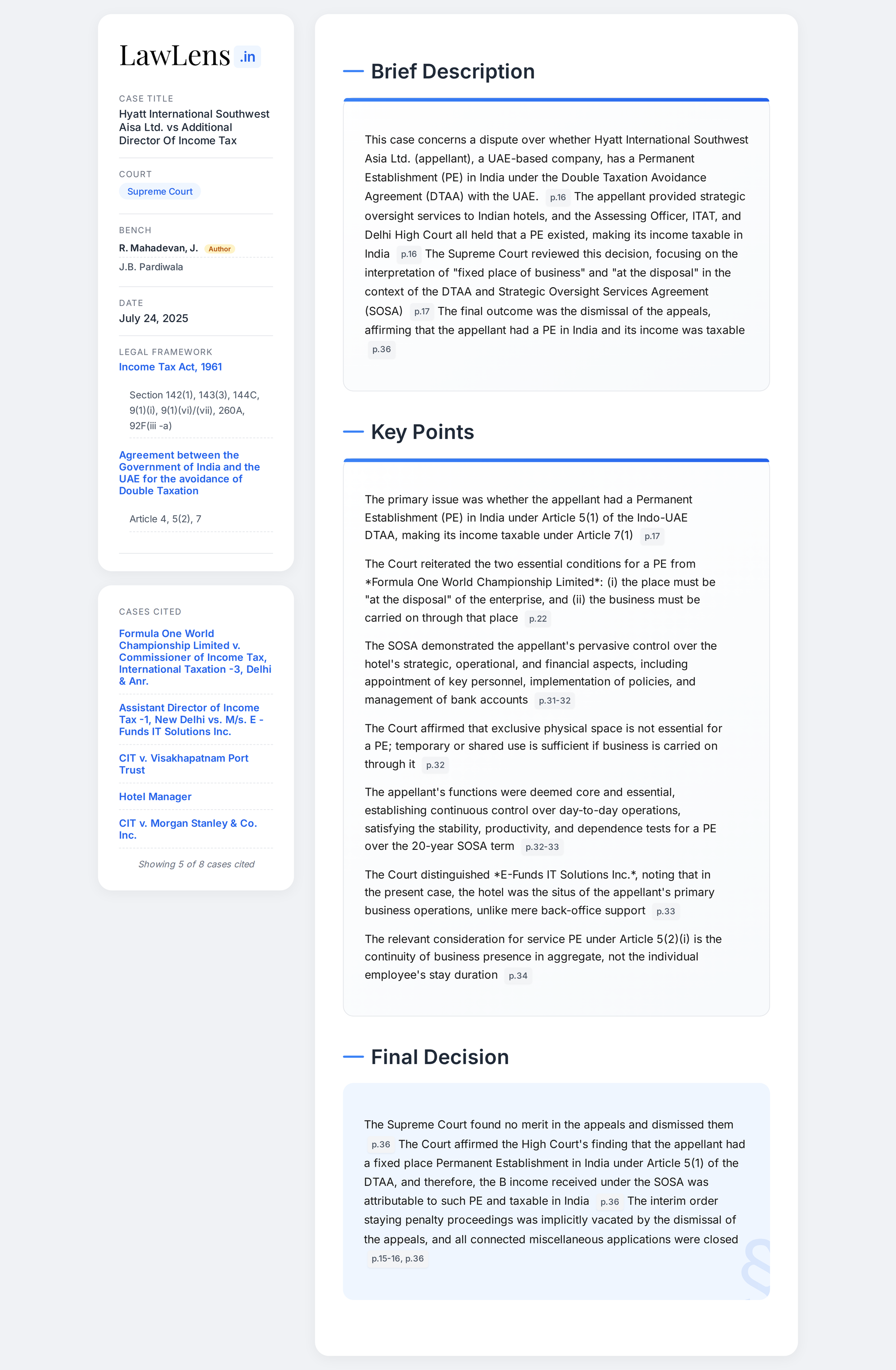

Case Info

Coram: J.B. Pardiwala, J. R. Mahadevan, J.

Judgment Date: July 24, 2025

Caselaws and Citations Referred

- Formula One World Championship Limited v. Commissioner of Income Tax, International Taxation-3, Delhi & Anr., (2017) 15 SCC 602

- Assistant Director of Income Tax-1, New Delhi vs. M/s. E-Funds IT Solutions Inc., (2018) 13 SCC 294

- Union of India & Anr. v. U.A.E Exchange Centre, (2020) 9 SCC 329

- CIT v. Visakhapatnam Port Trust, 1983 SCC OnLine AP 287: (1983) 144 ITR 146

- CIT v. Morgan Stanley & Co. Inc., (2007) 7 SCC 1

- Motorola Inc. v. Dy. CIT, 2005 SCC OnLine ITAT 1 : (2005) 95 ITD 269 (Delhi)

Statutes/Laws Referred

- Income Tax Act, 1961 (Sections 9(1)(i), 9(1)(vi), 9(1)(vii), 92F(iii-a), 142(1), 143(3), 144C, 260A)

- Agreement between the Government of India and the UAE for the Avoidance of Double Taxation (DTAA)

- UN Model Double Taxation Convention (2021)

- OECD Model Tax Convention (2017)

#SupremeCourt judgment on “Permanent Establishment” under DTAA. https://t.co/7RAmn7meMI pic.twitter.com/FNAIOdg7k1

— CiteCase 🇮🇳 (@CiteCase) July 24, 2025

Suggested Readings: