Director of Income Tax (IT)-I, Mumbai v. American Express Bank Ltd.; 2025 INSC 1431 -S.44C Income Tax Act - Head Office Expenditure - Interpretation Of Taxation Statutes

You can read our notes on this judgment in our Supreme Court Daily Digests. If you are our subscriber, you should get it in our Whatsapp CaseCiter Community at about 9pm on every working day. If you are not our subscriber yet, you can register by clicking here:

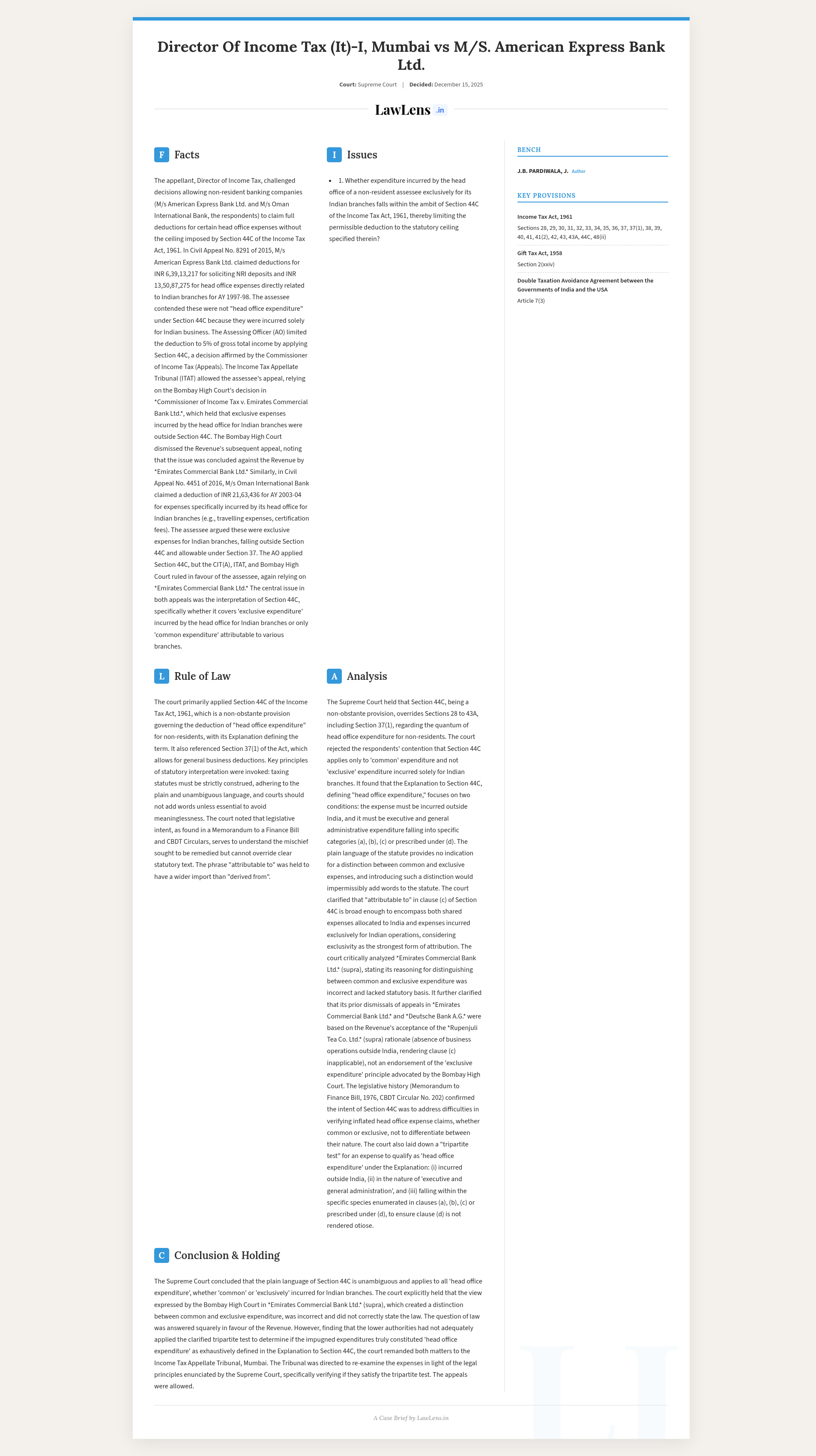

Income Tax Act - Section 44C -Section 44C applies to ‘head office expenditure’ regardless of whether it is common expenditure or expenditure incurred exclusively for the Indian branches (Para 88)- a) Section 44C is a special provision that exclusively governs the quantum of allowable deduction for any expenditure incurred by a non-resident assessee that qualifies as ‘head office expenditure’. b) For an expenditure to be brought within the ambit of Section 44C, two broad conditions must be satisfied: (i) The assessee claiming the deduction must be a non-resident; and (ii) The expenditure in question must strictly fall within the definition of ‘head office expenditure’ as provided in the Explanation to the Section. c) The Explanation prescribes a tripartite test to determine if an expense qualifies as ‘head office expenditure’ - (i) The expenditure was incurred outside India; (ii) The expenditure is in the nature of ‘executive and general administration’ expenses; and (iii) The said executive and general administration expenditure is of the specific kind enumerated in clauses (a), (b), or (c) respectively of the Explanation, or is of the kind prescribed under clause (d). d) Once the conditions in (b) referred to above are met, the operative part of Section 44C gets triggered. Consequently, the allowable deduction is restricted to the least of the following two amounts: (i) an amount equal to 5% of the adjusted total income; or (ii) the amount of head office expenditure specifically attributable to the business or profession of the assessee in India.

Interpretation of Statutes -Taxation Statutes - a) Taxation statutes require strict interpretation. b) Where the words are plain and unambiguous, the court is bound to give effect to their plain meaning. c) The determination of whether language is ‘plain and unambiguous’ is not a mechanical exercise, and it necessitates interpreting words within their specific context rather than in isolation. d) The legislative intent is primarily to be gathered from the specific words used by the legislature. Reference to the object and purpose becomes crucial in those situations where the language is ambiguous and capable of multiple constructions. e) Under ordinary circumstances, it is impermissible for the Court to add or read words into the statute, especially when the language is plain and unambiguous, on the notion that such words would appear to better serve the legislative object or purpose. (Para 40)

Case Info

Case Information

- Case name: Director of Income Tax (IT)-I, Mumbai v. M/s. American Express Bank Ltd.; with Director of Income Tax v. Oman International Bank

- Neutral citation: 2025 INSC 1431

- Coram: J.B. Pardiwala, J.; K.V. Viswanathan, J.

- Judgment date: December 15, 2025

Caselaws and Citations

- Commissioner of Income Tax v. Kasturi & Sons Ltd., (1999) 3 SCC 346.

- A.V. Fernandez v. State of Kerala, 1957 SCC OnLine SC 23.

- Commissioner of Sales Tax, U.P. v. Modi Sugar Mills Ltd., 1960 SCC OnLine SC 118.

- State of U.P. v. Dr. Vijay Anand Maharaj, 1962 SCC OnLine SC 12.

- M.V. Joshi v. M.U. Shimpi, 1961 SCC OnLine SC 56.

- Godrej & Boyce Mfg. Co. Ltd. v. DCIT, (2017) 7 SCC 421.

- Commissioner of Gift Tax v. N.S. Getty Chettiar, (1971) 2 SCC 741.

- RBI v. Peerless General Finance, (1987) 1 SCC 424.

- Sri Ram Narain Medhi v. State of Bombay, 1958 SCC OnLine SC 53.

- Dadi Jagannadham v. Jammulu Ramulu, (2001) 7 SCC 71.

- Commissioner of Income Tax, Kerala v. Tara Agencies, (2007) 6 SCC 429.

- Bengal Immunity Co. Ltd. v. State of Bihar, (1955) 1 SCC 763.

- Commissioner of Income Tax, MP v. Sodra Devi, 1957 SCC OnLine SC 33.

- Kanai Lal Sur v. Paramnidhi Sadhukhan, 1957 SCC OnLine SC 8.

- CIT v. B.C. Srinivasa Setty, (1981) 128 ITR 294 (SC).

- Rupenjuli Tea Co. Ltd. v. CIT, 1989 SCC OnLine Cal 410; (1990) 186 ITR 301 (Cal).

- CIT v. Deutsche Bank A.G., 2003 SCC OnLine Bom 1286.

- CIT v. Emirates Commercial Bank Ltd., 2003 SCC OnLine Bom 1280.

- DIT v. Ravva Oil (Singapore) Pvt. Ltd., 2006 SCC OnLine Del 1742.

- CIT v. Meghalaya Steels Ltd., (2016) 6 SCC 747.

Statutes/Laws Referred

- Income Tax Act, 1961:

- Section 37(1)

- Section 44C (including Explanation clause (iv)(a)–(d))

- Sections 28 to 43A; Section 29; Sections 30–43D

- Finance Act, 1993 (omission of Section 44C clause (b))

- Memorandum to Finance Bill, 1976; CBDT Circular No. 202 (05.07.1976)

- Double Taxation Avoidance Agreement (India–USA), Article 7(3)

- Principles of Statutory Interpretation (context cited; G.P. Singh) and Notes on Clauses (delegated legislation for Section 44C)

#SupremeCourt holds that Section 44C Income Tax Act applies to ‘head office expenditure’ regardless of whether it is common expenditure or expenditure incurred exclusively for the Indian branches. https://t.co/eFkr64nVXE pic.twitter.com/RWZ6dsPlyH

— CiteCase 🇮🇳 (@CiteCase) December 15, 2025

#SupremeCourt judgment on how to interpret Taxation Statutes: https://t.co/eFkr64nVXE pic.twitter.com/00tHd69iL8

— CiteCase 🇮🇳 (@CiteCase) December 15, 2025