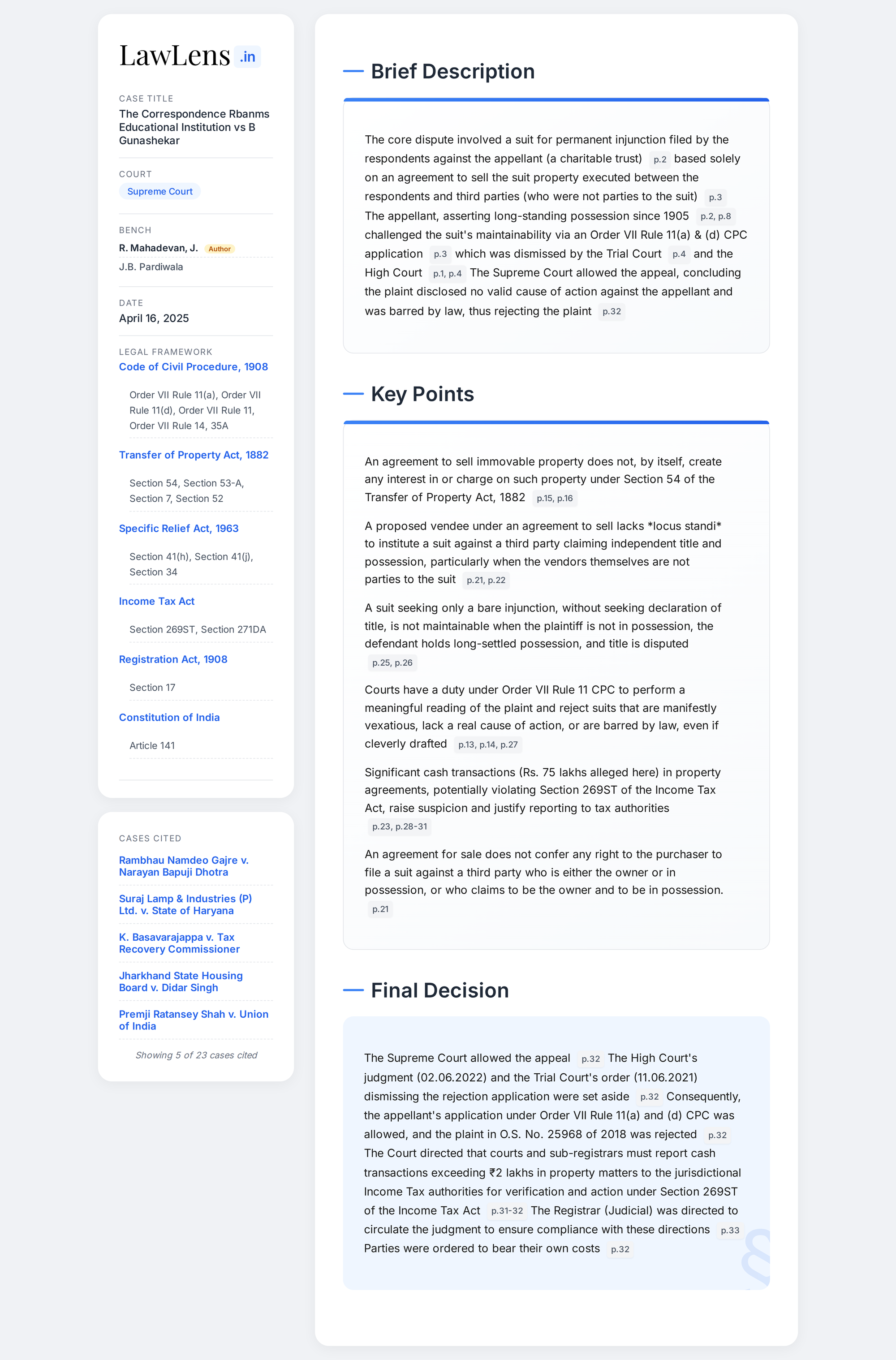

Correspondence, RBANMS Educational Institution vs B. Gunashekar 2025 INSC 490 - TP Act - Income Tax

Civil Suits - Income Tax Act 1961 - Section 269ST -(A) Whenever, a suit is filed with a claim that Rs. 2,00,000/- and above is paid by cash towards any transaction, the courts must intimate the same to the jurisdictional Income Tax Department to verify the transaction and the violation of Section 269ST of the Income Tax Act, if any, (B) Whenever, any such information is received either from the court or otherwise, the Jurisdictional Income Tax authority shall take appropriate steps by following the due process in law, (C) Whenever, a sum of Rs. 2,00,000/- and above is claimed to be paid by cash towards consideration for conveyance of any immovable property in a document presented for registration, the jurisdictional Sub-Registrar shall intimate the same to the jurisdictional Income Tax Authority who shall follow the due process in law before taking any action, (D) Whenever, it comes to the knowledge of any Income Tax Authority that a sum of Rs. 2,00,000/- or above has been paid by way of consideration in any transaction relating to any immovable property from any other source or during the course of search or assessment proceedings, the failure of the registering authority shall be brought to the knowledge of the Chief Secretary of the State/UT for initiating appropriate disciplinary action against such officer who failed to intimate the transactions.

Code of Civil Procedure 1908 - Order VII Rule 11 -Order VII Rule 11 CPC serves as a crucial filter in civil litigation, enabling courts to terminate proceedings at the threshold where the plaintiff's case, even if accepted in its entirety, fails to disclose any cause of action or is barred by law, either express or by implication - There is a bounden duty on the Court to discern and identify fictitious suit, which on the face of it would be barred, but for the clever pleadings disclosing a cause of action, that is surreal. Generally, sub-clauses (a) and (d) are stand alone grounds, that can be raised by the defendant in a suit. However, it cannot be ruled out that under certain circumstances, clauses (a) and (d) can be mutually inclusive. For instances, when clever drafting veils the implied bar to disclose the cause of action; it then becomes the duty of the Court to lift the veil and expose the bar to reject the suit at the threshold. The power to reject a plaint under this provision is not merely procedural but substantive, aimed at preventing abuse of the judicial process and ensuring that court time is not wasted on fictitious claims failing to disclose any cause of action to sustain the suit or barred by law. (Para 14.1) - Only averments in the plaint are to be considered under Order VII Rule 11 CPC. While it is true that the defendant's defense is not to be considered at this stage, this does not mean that the court must accept patently untenable claims or shut its eyes to settled principles of law and put the parties to trial, even in cases which are barred and the cause of action is fictitious. (Para 17) When the defects go to the root of the case, barred by law with fictitious allegations and are incurable, no amount of evidence can salvage the case (Para 16) Merely including a paragraph on cause of action is not sufficient but rather, on a meaningful reading of the plaint and the documents, it must disclose a cause of action. The plaint should contain such cause of action that discloses all the necessary facts required in law to sustain the suit and not mere statements of fact which fail to disclose a legal right of the plaintiff to sue and breach or violation by the defendant(s). It is pertinent to note here that even if a right is found, unless there is a violation or breach of that right by the defendant, the cause of action should be deemed to be unreal. This is where the substantive laws like Specific Relief Act, 1963, Contract Act, 1872, and Transfer of Property Act, 1882, come into operation. A pure question of law that can be decided at the early stage of litigation, ought to be decided at the earliest stage. In the present case, the respondents' claim based on an agreement to sell. (Para 15)

Transfer Of Property Act 1882 - Section 53A,54 - An agreement to sell does not confer any right on the proposed purchaser under the agreement. Therefore, as a natural corollary, any right, until the sale deed is executed, will vest only with the owner, or in other words, the vendor to take necessary action to protect his interest in the property (Para 15.2.1) - Though an agreement to sell creates certain rights, these rights are purely personal between the parties to the agreement and can only be enforced against the vendors or, in limited circumstances, under Section 53A of the Transfer of Property Act, 1882, against a subsequent transferee with notice - They cannot be enforced against third parties who claim independent title and possession.

Transfer Of Property Act 1882 - Section 53A - The applicability of Section 53-A of the Transfer of Property Act, 1882 is subject to certain conditions viz., (a) the agreement must be in writing with the owner of the property or in other words, the transferor must be either the owner or his authorised representative, (b) the transferee must have been put into possession or must have acted in furtherance of the agreement and made some developments, (c) the protection under Section 53-A is not an exemption to Section 52 of the Transfer of Property Act, 1882 or in other words, a transferee, put into possession with the knowledge of a pending lis, is not entitled to any protection, (d) the transferee must be in possession when the lis is initiated against his transferor and must be willing to perform the remaining part of his obligation, (e) the transferee must be entitled to seek specific performance or in other words, must not be barred by any of the provisions of the Specific Relief Act, 1963 from seeking such performance. The protection under Section 53-A is not available against a third party who may have an adversarial claim against the vendor. (Para 15.1)

Constitution of India - Article 141 - Ratio laid down by Supreme court, is applicable irrespective of the stage at which it is relied upon. What is relevant is the ratio and not the stage. Such contentions go against the spirit of Article 141 of the Constitution of India. Once a ratio is laid down, the courts have to apply the ratio, considering the facts of the case and once, found to be applicable, irrespective of the stage, the same has to be applied, to throw out frivolous suits. (Para 15.2)