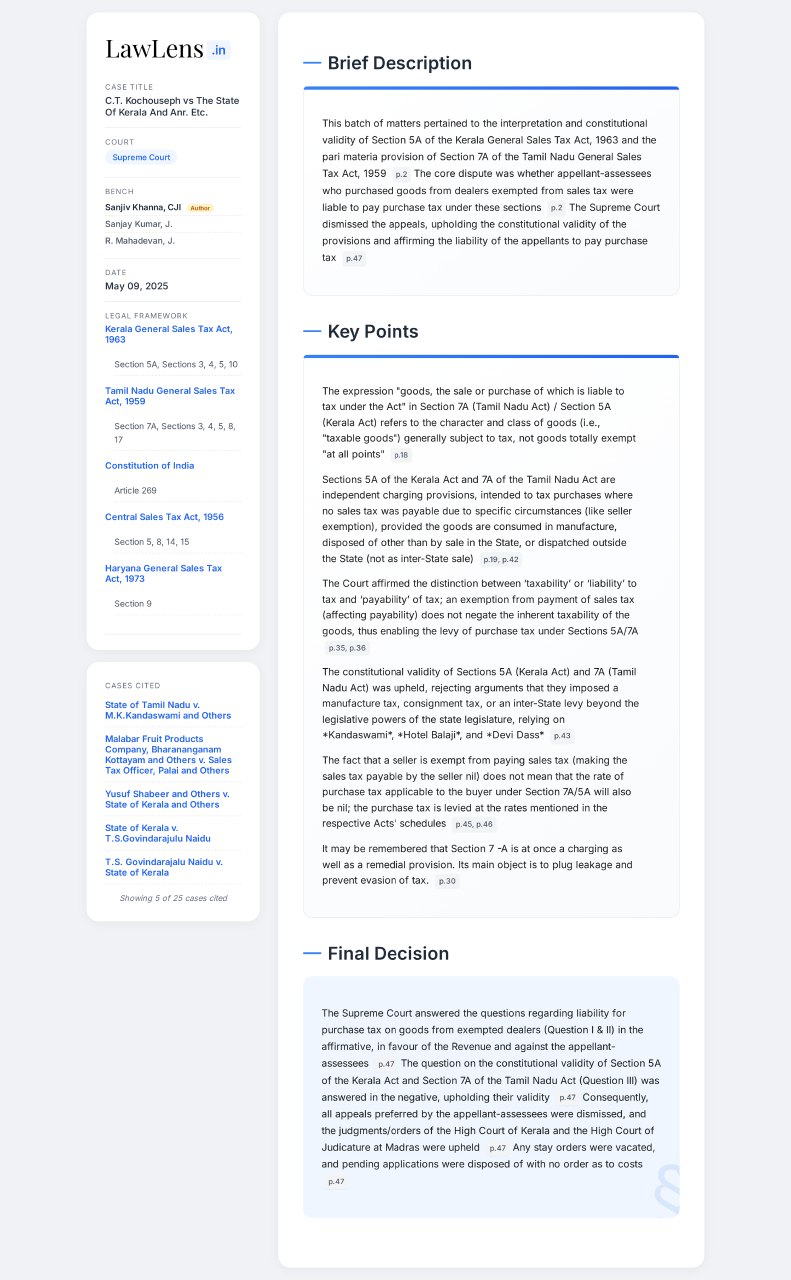

C.T. Kochouseph vs State Of Kerala 2025 INSC 661 - Kerala & TN General Sales Tax Act - Constitutional Validity

Kerala General Sales Tax Act, 1963-Section 5A - Tamil Nadu General Sales Tax Act, 1959 - Section 7A -Constitutional Validity upheld (Para 39) - Sections 5A or 7A, as the case may be, impose purchase tax specifically in situations where the seller is granted exemption from payment of tax - Exemption from payment of tax at the time of sale is a pre-condition for attracting Sections 5A and 7A respectively. Further, the fact that in case the goods were not exempt from payment of tax at the time of sale and the goods would have attracted tax at the first point of sale, is immaterial and inconsequential. Levy of purchase tax is governed by the provisions and stipulations of Sections 5A or 7A. They are independent and in a way constitute charging sections. Purchase tax is leviable on and payable by the purchaser. However, the legislations do not levy the purchase tax to tax the transaction of the sale and purchase twice. Instead, it levies purchase tax only where no sales tax was payable on the sale. Further, purchase tax has not been made leviable in all situations, except in three situations, namely, (a) where the goods on which no tax is paid were used in manufacture; or (b) where the goods were despatched out of the State other than by way of inter- State trade or commerce; or (c) where the goods are disposed of in a manner other than sale within the State. However, the need to satisfy the conditions do not change the nature of the charge, which is, tax on purchase. (Para 31)

Constitution of India - Seventh Schedule - State List - the event, that is inter-State movement of the goods, which does not amount to inter-State sale, falls within the legislative domain and power of the State Legislature. The State, when it imposes such tax, does not exceed its power to impose tax conferred by the State List as inter-State sale of goods is not being subjected to tax. (Para 32)

Interpretation of Statutes - Taxation Laws - While examining tax provisions, we must give sufficient latitude to the Legislature. Income generation in the form of taxes is an important source of revenue for both the State and the Central governments. Some play in the joints should be given to the Legislature while dealing with laws relating to taxation and economic activities except in case of encroachment upon the power to tax that is not vested with them in terms of the Union or the State List, etc. (Para 33)