ASP Traders vs. State of Uttar Pradesh 2025 INSC 890 - S.129 CGST Act

Central Goods and Services Tax Act, 2017 - Section 129 - Whether, upon payment of tax and penalty by the assessee within the time stipulated in the notice under section 129(3), the proper officer is still mandatorily required to pass a final order under section 129(3), or whether the deeming fiction under section 129(5) dispenses with such requirement?: While Section 129(5) provides that proceedings shall be deemed to be concluded upon payment of tax and penalty, this deeming fiction cannot be interpreted to imply that the assessee has agreed to waive or abandon the right to challenge the levy – a right that is protected by the very enactment itself. The term “conclusion” as used in Section 129(5) merely signifies that no further proceedings for prosecution will be initiated. It does not absolve the responsibility of the proper officer to pass an order concluding the proceedings. Therefore, the proper officer is duty-bound to pass a formal order in Form GST MOV-09 and upload a summary thereof in Form GST DRT 07 as mandated under Rule 142(5) and the Circular dated 13.04.2018, so as to enable the taxpayer to avail the appeal remedy as per law. (Para 14) Once objections are filed, adjudication is not optional, it becomes imperative to pass a speaking order to justify the demand of tax and penalty, to safeguard the right of appeal under Section 107. The language of section 129(3) is categorical in stating that the officer “shall issue a notice… and thereafter, pass an order”. The use of the words “and thereafter” reinforces the mandatory nature of passing a reasoned order, regardless of payment, particularly where protest or dispute is raised. (Para 14-15)

Constitution of India - Article 265 - Show Cause Notice - Every show cause notice must culminate in a final, reasoned order- Failure to issue a speaking order in response to a show cause notice creates a legal vacuum. Any consequential action including imposition of tax or penalty, would then be unsupported by authority of law, thereby potentially violating Article 265 of the Constitution of India, which prohibits the levy or collection of tax except by authority of law. (Para 14,18)

Legal Maxims and Doctrines - Waiver and Acquiescence- A waiver is an abandonment of a right by express terms or by implication. It is an act by which a party elects to abandon his right to pursue a particular remedy with full knowledge of its existence, making the other party to alter his position or legal status. Acquiescence, on the other hand, will imply the conduct of a party, who refrains from taking any action for a long period of time, despite the knowledge of the violation of his right, thereby precluding his future right to agitate the issue, as it would be hit by laches- There must be much more than an abandonment of a right to plead waiver or acquiescence(Para 16.2)

Taxation Law - There can be no acquiescence in tax. (Para 16.1)

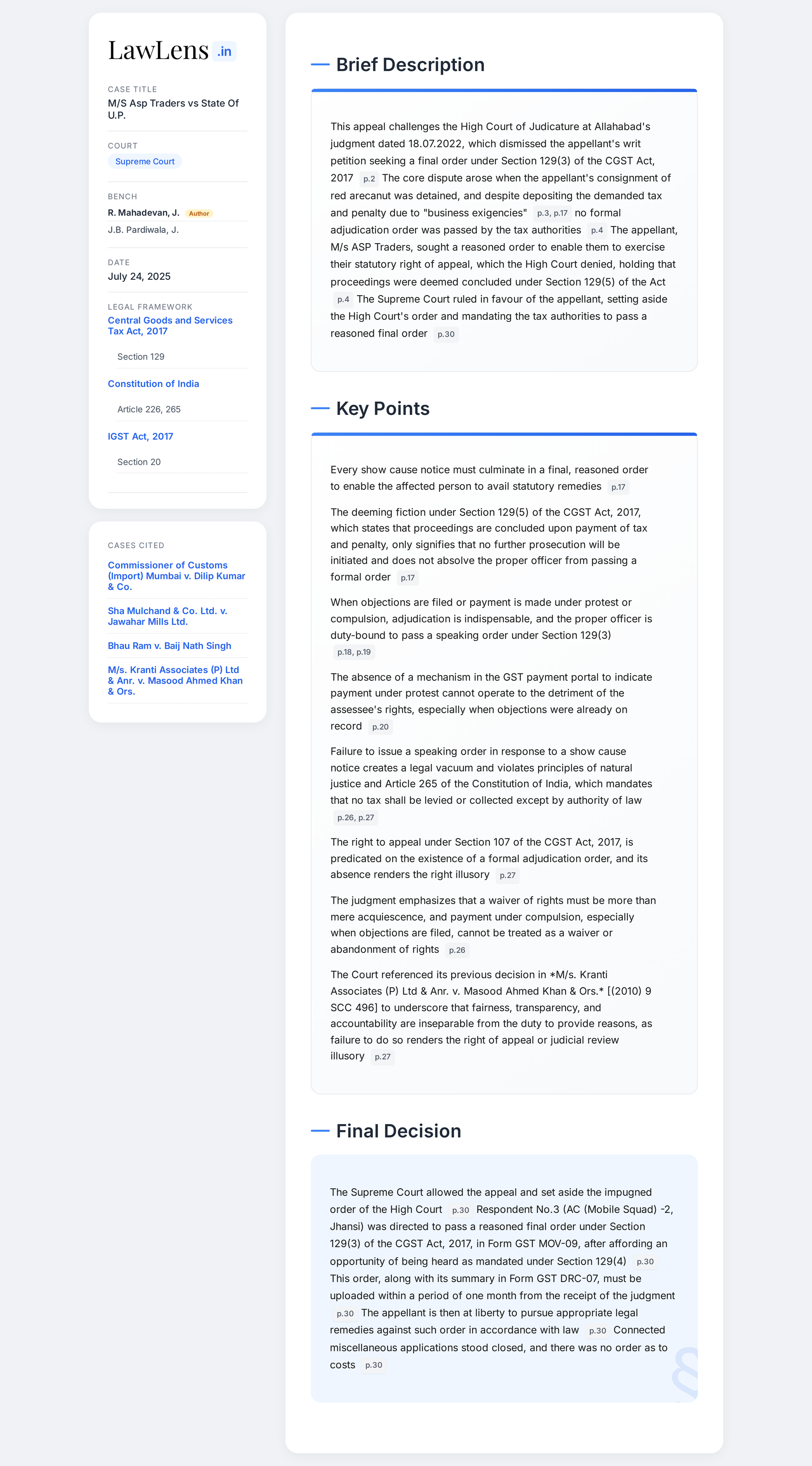

Case Details

Coram: R. Mahadevan, J. andJ.B. Pardiwala, J.

Judgment Date: July 24, 2025

Caselaws and Citations Referred

- Commissioner of Customs (Import) Mumbai v. Dilip Kumar & Co. and others (2018) 9 SCC 1

- Sha Mulchand & Co. Ltd. v. Jawahar Mills Ltd. MANU: SC/011/1952 : AIR 1953 SC 98

- Bhau Ram v. Baij Nath Singh and Ors. MANU/0031/SC/1961 : AIR 1961 SC 1327

- M/s. Kranti Associates (P) Ltd & Anr. v. Masood Ahmed Khan & Ors. (2010) 9 SCC 496 : (2010) 3 SCC (Civ) 852 : 2010 SCC OnLine SC 987

Statutes/Laws Referred

- Central Goods and Services Tax Act, 2017 (CGST Act, 2017)

- Section 129 (Detention, seizure and release of goods and conveyances in transit)

- Section 107 (Right of appeal)

- Section 168 (Power to issue instructions or directions)

- Article 265 of the Constitution of India (No tax shall be levied or collected except by authority of law)

- Central Goods and Services Tax Rules, 2017 (CGST Rules, 2017)

- Rule 142 (Notice and order for demand of amounts payable under the Act)

- Integrated Goods and Services Tax Act, 2017 (IGST Act, 2017)

- Section 20 (Application of provisions of CGST Act)

- Uttar Pradesh Goods and Services Tax Act (UPGST Act)

- Circular No. 41/15/2018-GST dated 13.04.2018 (CBIC, GST Policy Wing)

- Article 226 of the Constitution of India (Power of High Courts to issue certain writs)

- 101st Constitutional Amendment Act, 2016

"Every show cause notice must culminate in a final, reasoned order."#SupremeCourt held that, in proceedings under Section 129 CGST Act, the Proper Officer should pass a reasoned order, regardless of payment, particularly where protest or dispute is raised. https://t.co/uGlRt0Waku pic.twitter.com/GT8ywSvouj

— CiteCase 🇮🇳 (@CiteCase) July 24, 2025

#SupremeCourt on difference between ‘waiver’ and ‘acquiescence’ : https://t.co/uGlRt0Waku pic.twitter.com/vdOugsWIjh

— CiteCase 🇮🇳 (@CiteCase) July 24, 2025

GST Practitioners may please note that #SupremeCourt has delivered an important judgment interpreting Section 129 of CGST Act ! https://t.co/uGlRt0Waku pic.twitter.com/sU3pIJ4tE9

— CiteCase 🇮🇳 (@CiteCase) July 24, 2025

Suggested Readings: