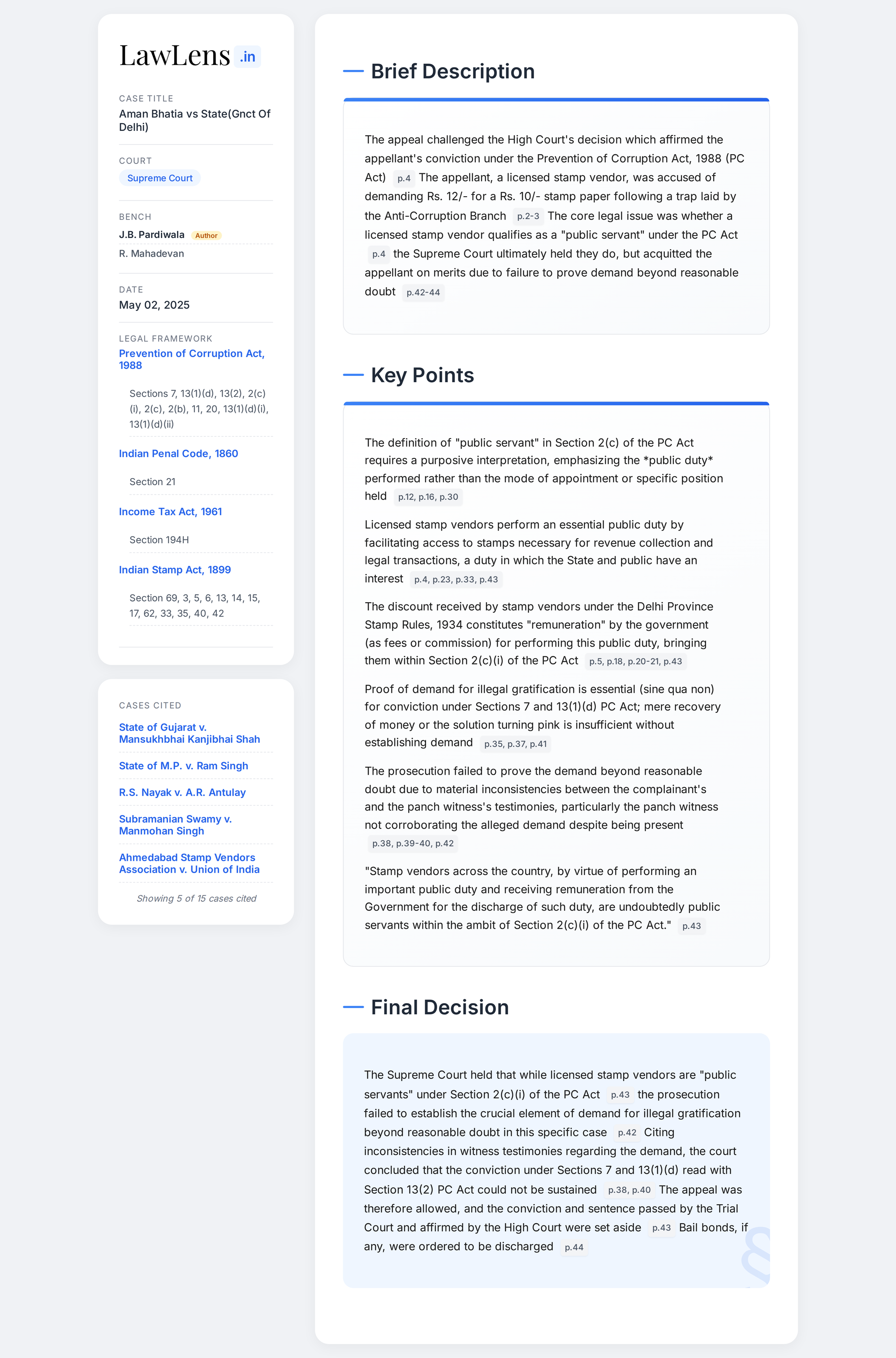

Aman Bhatia vs State (GNCT Of Delhi) 2025 INSC 618 - PC Act - Stamp Vendors Public Servants

Prevention of Corruption Act 1988 - Section 2(c)(i) - Stamp vendors across the country, by virtue of performing an important public duty and receiving remuneration from the Government for the discharge of such duty, are undoubtedly public servants within the ambit of Section 2(c)(i) of the PC Act. (Para 68.3)

Prevention of Corruption Act 1988 - Section 2(c)(i) -The definition of “public servant” as defined under the PC Act should be given a purposive and wide interpretation so as to advance the object underlying the statute- It is the nature of duty being discharged by a person which assumes paramount importance when determining whether such a person falls within the ambit of the definition of public servant as defined under the PC Act. (Para 68.1-68.2) A person would be a public servant under Section 2(c)(i) of the PC Act if he is: 1. in the service of the Government; or 2. in the pay of the Government; 3. remunerated by fees or commission for the performance of any public duty-.All three categories are independent of each other. There may be cases where more than one of the aforesaid categories are applicable and “or” may be read as “and”, however, the present case does not warrant such reading. (Para 17-18)

Prevention of Corruption Act 1988 - Section 7,13- Mere possession and recovery of tainted currency notes from a public servant, in the absence of proof of demand, is not sufficient to establish an offence under Sections 7 and 13(1)(d) of the PC Act respectively- without evidence of demand for illegal gratification, it cannot be said that the public servant used corrupt or illegal means, or abused his position, to obtain any valuable thing or pecuniary advantage.(Para 55)

Prevention of Corruption Act 1988 - Section 20-Presumption is drawn only qua the offence under Sections 7 and 11 respectively and not qua the offence under Section 13(1)(d) of the PC Act. The presumption is contingent upon the proof of acceptance of illegal gratification to the effect that the gratification was demanded and accepted as a motive or reward as contemplated under Section 7 of the PC Act. Such proof of acceptance can follow only when the demand is proved. The presumption under Section 20 arises once it is established that the public servant accepted the gratification. However, in determining whether such acceptance occurred, the totality of the evidence led at the trial must be appreciated. The evidence led by the prosecution, the suggestions made by the defence witnesses, if any, the entire record is required to be considered. Only if the cumulative effect of all the evidence is such that the sole possible conclusion is that the public servant accepted the gratification can it be said that the prosecution has established its case beyond reasonable doubt. (Para 64- 66)

Interpretation of Statutes- Where the wording of a statutory provision indicates that the legislature has consciously attributed varying degrees of significance to different interpretative elements such as the nature of the relationship or the duty performed, the courts are obliged to adhere to that legislative determination and interpret the provision in a manner that reflects the intended statutory scheme. While interpreting a statute, it is essential not only to consider the words used but also to examine the Statement of Objects and Reasons, as it provides the background against which the legislation was enacted- It is an important rule of interpretation that every interpretation of a statute must be undertaken by considering the statute in its entirety, the prior state of the law, other statutes in pari materia, the general scope and purpose of the legislation, and the mischief that the legislature intended to address. (Para 43-44) The interpretation of a definition should not only avoid being repugnant to the context but it should also be interpreted to achieve the purpose which is sought to be served by the statute. A construction which would defeat or may likely defeat the purpose of the Act has to be ignored and not accepted. A definition, like any other word in a statute, has to be read in the light of the context and scheme of the Act. (Para 39)

Supreme Court holds that Stamp vendors are public servants within the ambit of Section 2(c)(i) of the Prevention of Corruption Act. https://t.co/BFksZ4R71i pic.twitter.com/ulw9aDxJed

— CiteCase 🇮🇳 (@CiteCase) May 2, 2025

22 Years Of Just ₹2 Corruption Case!

— CiteCase 🇮🇳 (@CiteCase) May 2, 2025

In 2003, a stamp vendor allegedly demanded ₹12 for a ₹10 stamp paper.

A complaint was lodged and he was prosecuted under Prevention of Corruption Act.

Trial Court convicted him and the High Court dismissed his appeal.

Now after 22… https://t.co/BFksZ4R71i pic.twitter.com/aFwzKL3jk5